Business, 11.02.2020 01:45 aspenwheeler6804

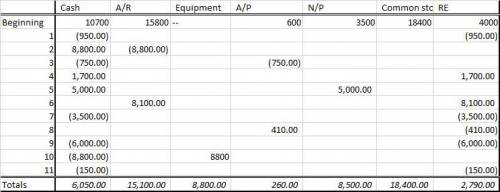

Grant Appraisal Service provides commercial and industrial appraisals and feasibility studies. On January 1, the assets and liabilities of the business were the following:Cash $10,700Accounts Receivable 15,800Accounts Payable 600Notes Payable 3,500Common Stock 18,400Retained Earnings 4,000The following transactions occurred during the month of January:Jan:

1 Paid rent for January, $950.2 Received $8,800 payment on customers' accounts.3 Paid $750 on accounts payable.4 Received $1,700 for services performed for cash customers.5 Borrowed $5,000 from a bank and signed a note payable for that amount.6 Billed the city $6,200 for a feasibility study performed; billed various other credit customers, $1,900.7 Paid the salary of an assistant, $3,500.8 Received invoice for January utilities, $410.9 Paid $6,000 cash for employee salaries.10 Purchased a van (on January 31) for business use, $8,800.11 Paid $150 to bank as January interest on the outstanding note payable. Required:(a) Set up an accounting equation in columnar form with the following individual assets, liabilities, and stockholders' equity accounts: Cash, Accounts Receivable, Van, Accounts Payable, Notes Payable, Common Stock, and Retained Earnings. Enter the January 1 balances below each item.(Note: The beginning Van account balance is $0.)(b) Show the impact (increase or decrease) of transactions 1-11 on the beginning balances, and total the columns to show that assets equal liabilities plus stockholders' equity as of January 31.

Answers: 2

Another question on Business

Business, 23.06.2019 14:00

If china enforces the software procurement regulation, the most likely result is

Answers: 1

Business, 23.06.2019 15:40

Select the correct answer. after the 2008 recession, the amount of reserves in the us banking system increased. because of federal reserve actions, required reserves increased from $44 billion to $60 billion. however, banks started holding more reserves than required. by january 2009, banks were holding $900 billion in excess reserves. the federal reserve started paying interest on the excess reserves that the banks held. what possible impact will these unused reserves have on the economy? a. the interest rate on loans will fall. b. people will demand more foreign goods. c. people will start borrowing more money. d. the economy will face inflation. e. foreign investments will increase.

Answers: 3

Business, 23.06.2019 22:00

If 12 million pairs of shoes are sold, , which means that: it would be more efficient for society to devote fewer resources to the production of shoes. it would be fairer for society to devote fewer resources to the production of shoes. society is currently devoting the efficient quantity of resources to the production of shoes. it would be fairer for society to devote more resources to the production of shoes. it would be more efficient for society to devote more resources to the production of shoes.

Answers: 3

Business, 23.06.2019 22:30

"ellie purchases an insurance policy on her life and names her brother, jason, as the beneficiary. ellie pays $32,000 in premiums for the policy during her life. when she dies, jason collects the insurance proceeds of $500,000."

Answers: 1

You know the right answer?

Grant Appraisal Service provides commercial and industrial appraisals and feasibility studies. On Ja...

Questions

Spanish, 18.09.2019 14:00

Biology, 18.09.2019 14:00

Mathematics, 18.09.2019 14:10

Chemistry, 18.09.2019 14:10

Biology, 18.09.2019 14:10

Biology, 18.09.2019 14:10

Mathematics, 18.09.2019 14:10

History, 18.09.2019 14:10

Mathematics, 18.09.2019 14:10