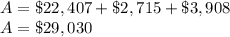

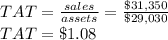

The Harrisburg Store has net working capital of $2,715, net fixed assets of $22,407, sales of $31,350, and current liabilities of $3,908. How many dollars' worth of sales are generated from every $1 in total assets? Select one: a. $1.08 b. $1.14 c. $1.19 d. $84 e. $93

Answers: 2

Another question on Business

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

Business, 22.06.2019 19:40

When a company produces and sells x thousand units per week, its total weekly profit is p thousand dollars, where upper p equals startfraction 800 x over 100 plus x squared endfraction . the production level at t weeks from the present is x equals 4 plus 2 t. find the marginal profit, startfraction dp over dx endfraction and the time rate of change of profit, startfraction dp over dt endfraction . how fast (with respect of time) are profits changing when tequals8?

Answers: 1

Business, 22.06.2019 20:00

Because this market is a monopolistically competitive market, you can tell that it is in long-run equilibrium by the fact thatmr=mc at the optimal quantity for each firm. furthermore, a monopolistically competitive firm's average total cost in long-run equilibrium isless than the minimum average total cost. true or false: this indicates that there is a markup on marginal cost in the market for engines. true false monopolistic competition may also be socially inefficient because there are too many or too few firms in the market. the presence of the externality implies that there is too little entry of new firms in the market.

Answers: 3

Business, 23.06.2019 02:00

Present values. the 2-year discount factor is .92. what is the present value of $1 to be received in year 2? what is the present value of $2,000? (lo5-2)

Answers: 3

You know the right answer?

The Harrisburg Store has net working capital of $2,715, net fixed assets of $22,407, sales of $31,35...

Questions

Mathematics, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10

Chemistry, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10

English, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10

Mathematics, 21.11.2020 02:10