Business, 25.01.2020 02:31 zaynmaliky4748

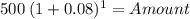

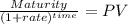

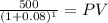

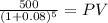

Find the following values for the lump sum assuming annual compounding: the future value of $500 invested at 8 percent for one year. future value=$500 * (1+0.08) ^1future value=$540the future value of $500 invested at 8 percent for five years. future value=$500 * (1+0.08) ^5future value=$734.66the present value of $500 to be received in one year when the opportunity cost rate is 8 percent. present value=$500/(1+0.08) ^1present value =$462.96the present value of $500 to be received in five years when the opportunity cost rate is 8 percent. present value=$500/(1+0.08) ^5present value =$340.29

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

Josie just bought her first fish tank a 36 -gallon glass aquarium, which she’s been saving up for almost a year to buy. for josie, the fish tank is most likely what type of purchase

Answers: 1

Business, 22.06.2019 14:30

crow design, inc. is a web site design and consulting firm. the firm uses a job order costing system in which each client is a different job. crow design assigns direct labor, licensing costs, and travel costs directly to each job. it allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. direct labor hours (professional) 6,250 hours direct labor costs ($1,800,000 support staff salaries ,000 computer ,000 office ,000 office ,000 in november 2012, crow design served several clients. records for two clients appear here: delicious treats mesilla chocolates direct labor 700 hours 100 hours software licensing $ 4,000 $400 travel costs 8,000 1. compute crow design’s direct labor rate and its predetermined indirect cost allocation rate for 2012. 2. compute the total cost of each job. 3. if simone wants to earn profits equal to 50% of service revenue, how much (what fee) should she charge each of these two clients? 4. why does crow design assign costs to jobs?

Answers: 2

Business, 22.06.2019 15:40

Aprice control is: question 1 options: a)a tax on the sale of a good that controls the market price.b)an upper limit on the quantity of some good that can be bought or sold.c)a legal restriction on how high or low a price in a market may go.d)control of the price of a good by the firm that produces it.

Answers: 1

Business, 22.06.2019 16:50

Identify and describe a variety of performance rating scales that can be used in organizations including graphical scales, letter scales, and numeric scales.

Answers: 2

You know the right answer?

Find the following values for the lump sum assuming annual compounding: the future value of $500 inv...

Questions

Chemistry, 19.01.2021 23:40

English, 19.01.2021 23:40

Mathematics, 19.01.2021 23:40

Mathematics, 19.01.2021 23:40

Mathematics, 19.01.2021 23:40

Computers and Technology, 19.01.2021 23:40

Biology, 19.01.2021 23:50

Mathematics, 19.01.2021 23:50