the equity section of cyril corporation's balance sheet shows the following:

Business, 24.01.2020 21:31 onlyceleste212

Question:

the equity section of cyril corporation's balance sheet shows the following:

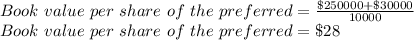

preferred stock: 4% cumulative, $25 par value, $30 call price, 10,000 shares issued and outstanding $250,000

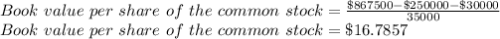

common stock: $10 par value, 35,000 shares issued and outstanding 350,000

retained earnings 267,500

total stockholders' equity $867,500

determine the book value per share of the preferred and common stock under two separate situations:

1. no preferred dividends are in arrears.

2. three years of preferred dividends are in arrears.

Answers: 3

Another question on Business

Business, 22.06.2019 01:10

Technology corp. is considering a $238,160 investment in a new marketing campaign that it anticipates will provide annual cash flows of $52,000 for the next five years. the firm has a 6% cost of capital. what should the analysis indicate to the firm's managers?

Answers: 2

Business, 22.06.2019 09:50

Beck company had the following accounts and balances at the end of the year. what is net income or net loss for the year? cash $ 74 comma 000 accounts payable $12,000 common stock $21,000 dividends $12,000 operating expenses $ 13 comma 000 accounts receivable $ 49 comma 000 inventory $ 47 comma 000 longminusterm notes payable $33,000 revenues $ 91 comma 000 salaries payable $ 30 comma 000

Answers: 1

Business, 22.06.2019 11:30

What would you do as ceo to support the goals of japan airlines during the challenging economics that airlines face?

Answers: 1

Business, 22.06.2019 12:50

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. consider all factors that affect the yield curve. then identify which of the following shapes that the u.s. treasury yield curve can take. check all that apply.

Answers: 2

You know the right answer?

Question:

the equity section of cyril corporation's balance sheet shows the following:

the equity section of cyril corporation's balance sheet shows the following:

Questions

Social Studies, 02.08.2019 02:30

History, 02.08.2019 02:30

French, 02.08.2019 02:30

English, 02.08.2019 02:30

History, 02.08.2019 02:30

History, 02.08.2019 02:30

Physics, 02.08.2019 02:30

Biology, 02.08.2019 02:30

In our case Cumulative dividends=0

In our case Cumulative dividends=0