Business, 21.01.2020 19:31 Bryson2148

Lifetime escapes generates average revenue of $7,500 per person on its 5-day package tours to wildlife parks in kenya. the variable costs per person are as follows:

$1,600

hotel $3,100

park tickets/other

$6,300

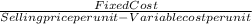

a] calculate the number of package tours that must be sold to break even.

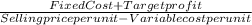

b]calculate the revenue needed to earn a target operating income of $102,000.

c] if fixed costs increase by $19,000, what decrease in variable cost er person must be achieved to maintain the breakeven point calculated in a.

d]the general manager of lifetime escapes proposes to increase the price of the package tour to $8,200 to decrease the breakeven point in units. using information in the origional problem, calculate the new breakeven point in units. what factors should the general manager consider before deciding to increase the price of the package tour?

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 07:10

Refer to the payoff matrix. suppose that speedy bike and power bike are the only two bicycle manufacturing firms serving the market. both can choose large or small advertising budgets. is there a nash equilibrium solution to this game?

Answers: 1

Business, 22.06.2019 23:30

Which statement best describes the two reactions? abcl, + h2 → 2hci2h + h = he + inreaction a involves a greater change, and reaction b involves a change in element identity.reaction b involves a greater change and a change in element identityreaction a involves a greater change and a change in element identity.reaction b involves a greater change, and reaction a involves a change in element identity.

Answers: 1

Business, 23.06.2019 02:00

Imprudential, inc., has an unfunded pension liability of $572 million that must be paid in 25 years. to assess the value of the firm’s stock, financial analysts want to discount this liability back to the present. if the relevant discount rate is 6.5 percent, what is the present value of this liability? (do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89)

Answers: 3

You know the right answer?

Lifetime escapes generates average revenue of $7,500 per person on its 5-day package tours to wildli...

Questions

Mathematics, 15.01.2022 22:50

History, 15.01.2022 22:50

Mathematics, 15.01.2022 22:50

Mathematics, 15.01.2022 22:50

Mathematics, 15.01.2022 22:50

Social Studies, 15.01.2022 22:50

Biology, 15.01.2022 22:50

Business, 15.01.2022 22:50

English, 15.01.2022 22:50

Mathematics, 15.01.2022 22:50

Mathematics, 15.01.2022 22:50

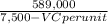

= $589,000

= $589,000