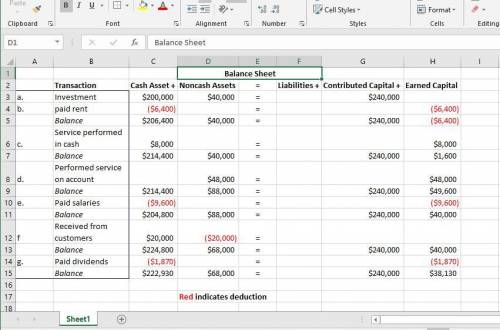

Analyzing and reporting financial statement effects of transactions m. e. carter launched carter company, a professional services firm on march 1. the firm will prepare financial statements at each month-end. in march (its first month), carter executed the following transactions. enter the transactions, a through g, into the financial statement effects template below. a. carter (owner) invested in the company $200,000 cash and $40,000 in property and equipment. the company issued common stock to carter. b. the company paid $6,400 cash for rent of office furnishings and facilities for march. c. the company performed services for clients and immediately received $8,000 cash earned. d. the company performed services for clients and sent a bill for $48,000 with payment due within 60 days. e. the company compensated an office employee with $9,600 cash as salary for march. f. the company received $20,000 cash as partial payment on the amount owed from clients in transaction d. g. the company paid $1,870 cash in dividends to carter (owner).

Answers: 3

Another question on Business

Business, 22.06.2019 05:30

Identify the three components of a family's culture and provide one example from your own experience

Answers: 2

Business, 22.06.2019 06:20

James albemarle created a trust fund at the beginning of 2016. the income from this fund will go to his son edward. when edward reaches the age of 25, the principal of the fund will be conveyed to united charities of cleveland. mr. albemarle specified that 75 percent of trustee fees are to be paid from principal. terry jones, cpa, is the trustee. james albemarle transferred cash of $500,000, stocks worth $400,000, and rental property valued at $250,000 to the trustee of this fund. immediately invested cash of $360,000 in bonds issued by the u.s. government. commissions of $7,900 are paid on this transaction. incurred permanent repairs of $9,000 so that the property can be rented. payment is made immediately. received dividends of $8,000. of this amount, $3,000 had been declared prior to the creation of the trust fund. paid insurance expense of $4,000 on the rental property. received rental income of $10,000. paid $8,000 from the trust for trustee services rendered. conveyed cash of $7,000 to edward albemarle.

Answers: 2

Business, 22.06.2019 09:30

An object that is clicked on and takes the presentation to a new targeted file is done through a

Answers: 2

Business, 22.06.2019 12:30

In the 1970s, kmart used blue light specials to encourage customers to flock to a particular department having a temporary sale. a spinning blue light activated for approximately 30 seconds, and then an in-store announcement informed shoppers of the special savings in the specific department. over time, loyal kmart shoppers learned to flock to the department with the spinning blue light before any announcement of special savings occurred. if kmart was employing classical conditioning techniques, what role did the spinning blue light play?

Answers: 3

You know the right answer?

Analyzing and reporting financial statement effects of transactions m. e. carter launched carter com...

Questions

Social Studies, 23.09.2020 06:01

Advanced Placement (AP), 23.09.2020 06:01

Advanced Placement (AP), 23.09.2020 06:01

Mathematics, 23.09.2020 06:01

English, 23.09.2020 06:01

History, 23.09.2020 06:01

English, 23.09.2020 06:01

Mathematics, 23.09.2020 06:01

Chemistry, 23.09.2020 06:01

Mathematics, 23.09.2020 06:01

English, 23.09.2020 06:01

Mathematics, 23.09.2020 06:01

Physics, 23.09.2020 06:01

Chemistry, 23.09.2020 06:01