Business, 21.01.2020 04:31 joshblubaugh

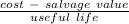

Amachine was purchased at a cost of $70,000. the equipment had an estimated useful life of eight years and a residual value of $6,000. assuming the equipment was sold at the end of year 6 for $14,000, determine the gain or loss on the sale of the equipment. (assume the straight-line depreciation method.)

Answers: 2

Another question on Business

Business, 22.06.2019 16:30

Bernard made a gift of $500,000 to his brother in 2014. due to bernard’s prior taxable gifts he paid $200,000 of gift tax. when bernard died in 2019, the applicable gift tax credit had increased. at bernard’s death, what amount related to the $500,000 gift to his brother is included in his gross estate?

Answers: 3

Business, 22.06.2019 21:50

scenario: hawaii and south carolina are trading partners. hawaii has an absolute advantage in the production of both coffee and tea. the opportunity cost of producing 1 pound of tea in hawaii is 2 pounds of coffee, and the opportunity cost of producing 1 pound of tea in south carolina is 1/3 pound of coffee. which of the following statements is true? a. south carolina should specialize in the production of both tea and coffee. b. hawaii should specialize in the production of tea, whereas south carolina should specialize in the production of coffee. c. hawaii should specialize in the production of coffee, whereas south carolina should specialize in the production of tea. d. hawaii should specialize in the production of both tea and coffee.

Answers: 1

Business, 22.06.2019 22:30

The answer here, x=7, is not in the interval that you selected in the previous part. what is wrong with the work shown above?

Answers: 1

You know the right answer?

Amachine was purchased at a cost of $70,000. the equipment had an estimated useful life of eight yea...

Questions

Mathematics, 31.12.2021 14:50

History, 31.12.2021 14:50

Social Studies, 31.12.2021 14:50

Mathematics, 31.12.2021 14:50

Social Studies, 31.12.2021 15:00

Biology, 31.12.2021 15:00

Mathematics, 31.12.2021 15:00