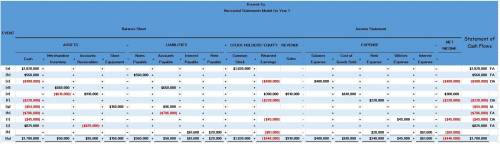

Use the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at kissick co. issued 260,000 shares of $7-par-value common stock for $1,820,000 in cash. borrowed $560,000 from oglesby national bank and signed a 11% note due in two years. incurred and paid $400,000 in salaries for the year. purchased $660,000 of merchandise inventory on account during the year. sold inventory costing $610,000 for a total of $970,000, all on credit. paid rent of $220,000 on the sales facilities during the first 11 months of the year. purchased $150,000 of store equipment, paying $54,000 in cash and agreeing to pay the difference within 90 days. paid the entire $96,000 owed for store equipment and $610,000 of the amount due to suppliers for credit purchases previously recorded. incurred and paid utilities expense of $45,000 during the year. collected $825,000 in cash from customers during the year for credit sales previously recorded. at year-end, accrued $61,600 of interest on the note due to oglesby national bank. at year-end, accrued $20,000 of past-due december rent on the sales facilities.

Answers: 2

Another question on Business

Business, 22.06.2019 04:10

What is the difference between secure bonds and naked bonds?

Answers: 1

Business, 22.06.2019 18:50

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

Business, 23.06.2019 02:50

Marcus nurseries inc.'s 2005 balance sheet showed total common equity of $2,050,000, which included $1,750,000 of retained earnings. the company had 100,000 shares of stock outstanding which sold at a price of $57.25 per share. if the firm had net income of $250,000 in 2006 and paid out $100,000 as dividends, what would its book value per share be at the end of 2006, assuming that it neither issued nor retired any common stock?

Answers: 1

Business, 23.06.2019 03:00

For example, the upper right cell shows that if expresso advertises and beantown doesn't advertise, expresso will make a profit of $15 million, and beantown will make a profit of $2 million. assume this is a simultaneous game and that expresso and beantown are both profit-maximizing firms. if expresso decides to advertise, it will earn a profit of $ million if beantown advertises and a profit of $ million if beantown does not advertise. if expresso decides not to advertise, it will earn a profit of $ million if beantown advertises and a profit of $ million if beantown does not advertise. if beantown advertises, expresso makes a higher profit if it chooses . if beantown doesn't advertise, expresso makes a higher profit if it chooses . suppose that both firms start off not advertising. if the firms act independently, what strategies will they end up choosing? expresso will choose to advertise and beantown will choose not to advertise. expresso will choose not to advertise and beantown will choose to advertise. both firms will choose to advertise. both firms will choose not to advertise.

Answers: 1

You know the right answer?

Use the horizontal model, or write the journal entry, for each of the following transactions and adj...

Questions

English, 24.02.2021 03:10

Mathematics, 24.02.2021 03:10

World Languages, 24.02.2021 03:10

Mathematics, 24.02.2021 03:10

Mathematics, 24.02.2021 03:10

History, 24.02.2021 03:10

English, 24.02.2021 03:10

Mathematics, 24.02.2021 03:10

Mathematics, 24.02.2021 03:10

Chemistry, 24.02.2021 03:10

Mathematics, 24.02.2021 03:10