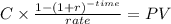

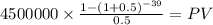

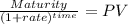

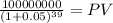

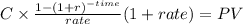

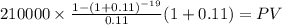

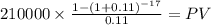

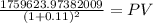

On the last day of its fiscal year ending december 31, 2018, the sedgwick & reams (s& r) glass company completed two financing arrangements. the funds provided by these initiatives will allow the company to expand its operations. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.)1. s& r issued 9% stated rate bonds with a face amount of $100 million. the bonds mature on december 31, 2036 (20 years). the market rate of interest for similar bond issues was 10% (5.0% semiannual rate). interest is paid semiannually (4.5%) on june 30 and december 31, beginning on june 30, 2019.2. the company leased two manufacturing facilities. lease a requires 20 annual lease payments of $210,000 beginning on january 1, 2019. lease b also is for 20 years, beginning january 1, 2019. terms of the lease require 17 annual lease payments of $230,000 beginning on january 1, 2022. generally accepted accounting principles require both leases to be recorded as liabilities for the present value of the scheduled payments. assume that an 11% interest rate properly reflects the time value of money for the lease obligations. required: what amounts will appear in s& r's december 31, 2018, balance sheet for the bonds and for the leases? (enter your answers in whole dollars. do not round intermediate calculations. round your final answers to nearest whole dollar amount.)

Answers: 2

Another question on Business

Business, 21.06.2019 23:00

Which of the following statements about the relationship between economic costs and accounting costs is true? multiple choice accounting costs are equal to or greater than economic costs. accounting costs must always equal economic costs. accounting costs are always greater than economic costs. accounting costs are always less than or equal to economic costs.

Answers: 2

Business, 22.06.2019 20:30

Read the overview below and complete the activities that follow.apartment complexes often look for ways to recruit new tenants and retain current tenants. although apartment complexes offer the tangible benefit of shelter to their tenants, many apartment complexes also offer additional services to tenants to encourage tenants to stay or to support the rent prices. the following scenario identifies the several service gaps of a company that runs an apartment complex as well as solutions for reducing these service gaps.concept review: customers have certain expectations about how a service should be delivered. a service gap occurs when the delivery of a service fails to meet customer expectations. there are four types of service gaps: knowledge gap, standards gap, delivery gap, and the communications gap. it is important for marketers to identify these gaps and develop strategies for minimizing them.match the example or solution to the appropriate service gap category.1. wait for repairs 5. train employees well2. understand expectations 6. incentives for tenants3. do not overpromise 7. family movie night4. empower employees 8. delayed lawn careservice gap example solutionknowledge gap standards gap delivery gap communication gap

Answers: 3

Business, 22.06.2019 21:30

Which of the following best explains why online retail companies have an advantage over regular stores? a. their employees make less money because they mostly perform unskilled tasks. b. they are able to keep distribution costs low by negotiating deals with shipping companies. c. their transactions require expensive state-of-the-art technological devices. d. they have a larger number of potential customers because people anywhere can buy from them.

Answers: 1

Business, 23.06.2019 02:10

Make or buy eastside company incurs a total cost of $120,000 in producing 10,000 units of a component needed in the assembly of its major product. the component can be purchased from an outside supplier for $11 per unit. a related cost study indicates that the total cost of the component includes fixed costs equal to 50% of the variable costs involved. a. should eastside buy the component if it cannot otherwise use the released capacity? present your answer in the form of differential analysis. use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. cost from outside supplier $answer variable costs avoided by purchasing answer net advantage (disadvantage) to purchase alternative $answer b. what would be your answer to requirement (a) if the released capacity could be used in a project that would generate $50,000 of contribution margin? use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers.

Answers: 2

You know the right answer?

On the last day of its fiscal year ending december 31, 2018, the sedgwick & reams (s& r) gl...

Questions

History, 17.09.2019 15:10

English, 17.09.2019 15:10

Physics, 17.09.2019 15:10

Social Studies, 17.09.2019 15:10

Mathematics, 17.09.2019 15:10

Mathematics, 17.09.2019 15:10

Biology, 17.09.2019 15:10

Physics, 17.09.2019 15:10

Biology, 17.09.2019 15:10

English, 17.09.2019 15:10

Mathematics, 17.09.2019 15:10

Health, 17.09.2019 15:10