Business, 15.01.2020 19:31 kristieL50

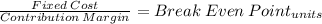

Requirement 3. suppose 250 comma 000 units are sold but only 50 comma 000 of them are deluxe. compute the operating income. compute the breakeven point in units. compare your answer with the answer to requirement 1. what is the major lesson of this problem? compute the operating income if 250 comma 000 units are sold but only 50 comma 000 of them are deluxe. standard carrier deluxe carrier total units sold 200,000 50,000 250,000 revenues at $28 and $50 per unit $5,600,000 $2,500,000 $8,100,000 variable costs at $18 and $30 per unit 3,600,000 1,500,000 5,100,000 contribution margin $2,000,000 $1,000,000 3,000,000 fixed costs 2,250,000 operating income $750,000 before calculating the breakeven points, determine the new sales mix. for every 1 deluxe carrier sold, 4 standard carriers are sold. compute the breakeven point in units, assuming the new sales mix. (round your answers up to the next whole number.) the breakeven point is 4 standard units and 1 deluxe units.

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

Why has the free enterprise system been modified to include some government intervention?

Answers: 1

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

Business, 22.06.2019 20:50

Swathmore clothing corporation grants its customers 30 days' credit. the company uses the allowance method for its uncollectible accounts receivable. during the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. at the fiscal year-end of december 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. at the end of 2012, accounts receivable were dollar 586.000 and the allowance account had a credit balance of dollar 50,000. accounts receivable activity for 2013 was as follows: the company's controller prepared the following aging summary of year-end accounts receivable: prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. (if no entry is required for a particular event, select "no journal entry required" in the first account field.) prepare the necessary year-end adjusting entry for bad debt expense. (if no entry is required for an event, select "no journal entry required" in the first account field.) what is total bad debt expense for 2013? calculate the amount of accounts receivable that would appear in the 2013 balance sheet?

Answers: 2

You know the right answer?

Requirement 3. suppose 250 comma 000 units are sold but only 50 comma 000 of them are deluxe. comput...

Questions

Biology, 17.10.2019 17:30

Chemistry, 17.10.2019 17:30

Mathematics, 17.10.2019 17:30

Mathematics, 17.10.2019 17:30

Biology, 17.10.2019 17:30

Mathematics, 17.10.2019 17:30

English, 17.10.2019 17:30

History, 17.10.2019 17:30

History, 17.10.2019 17:30

Mathematics, 17.10.2019 17:30

History, 17.10.2019 17:30