Inferring transactions from financial statements

costco wholesale corporation operates members...

Business, 15.01.2020 07:31 datboyjulio21

Inferring transactions from financial statements

costco wholesale corporation operates membership warehouses selling food, appliances, consumer electronics, apparel and other household goods at 582 locations across the u. s. as well as in canada, the united kingdom, japan, australia, south korea, taiwan, mexico and puerto rico. as of its fiscal year-end 2010, costco had approximately 60 million members. selected fiscal-year information from the company's balance sheets follows. ($ millions).

selected balance sheet data 2010 2009

merchandise inventories $5,638 $5,405

deferred membership income (liability) 869 824

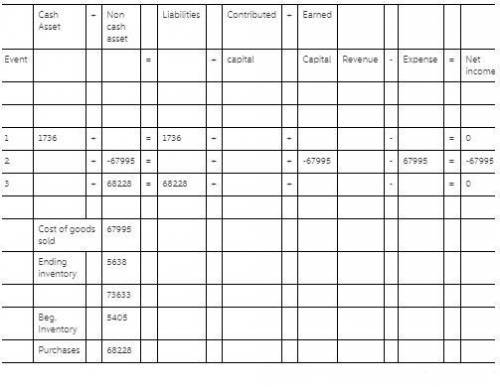

(a) during fiscal 2010, costco collected $1,736 cash for membership fees. use the financial statement effects template to record the cash collected for membership fees.

(b) in 2010, costco recorded $67,995 million in merchandise costs (that is, cost of goods sold). record this transaction in the financial statement effects template.

(c) determine the value of merchandise that costco purchased during fiscal-year 2010. use the financial statement effects template to record these merchandise purchases. assume all of costco's purchases are on credit.

balance sheet

transaction cash asset + noncash assets = liabilities + contributed capital + earned capital

(a)

(b)

(c)

income statement

revenue

-

expenses

=

net income

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a passive investment in a limited partnership, and a $26,000 passive loss from a real estate rental activity in which she actively participates. if her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible

Answers: 1

Business, 21.06.2019 22:30

True or false: banks are required to make electronically deposited funds available on the same day of the deposit

Answers: 2

Business, 22.06.2019 16:40

An electronics store is running a promotion where for every video game purchased, the customer receives a coupon upon checkout to purchase a second game at a 50% discount. the coupons expire in one year. the store normally recognized a gross profit margin of 40% of the selling price on video games. how would the store account for a purchase using the discount coupon?

Answers: 3

Business, 22.06.2019 23:10

Mr. pines is considering buying a house and renting it to students. the yearly operating costs are $1,900. the house can be sold for $175,000 at the end of 10 years and it is considered 18% to be a suitable annual effective interest rate. if the house costs $100,000 to purchase, how much would you need to charge your tenants each year in rent? (assume a single payment for the years rent at the end of each year)

Answers: 1

You know the right answer?

Questions

Advanced Placement (AP), 29.08.2021 07:00

English, 29.08.2021 07:00

Mathematics, 29.08.2021 07:00

Computers and Technology, 29.08.2021 07:00

History, 29.08.2021 07:00

English, 29.08.2021 07:00

English, 29.08.2021 07:10

Mathematics, 29.08.2021 07:10