Business, 15.01.2020 07:31 mayfieldashley2437

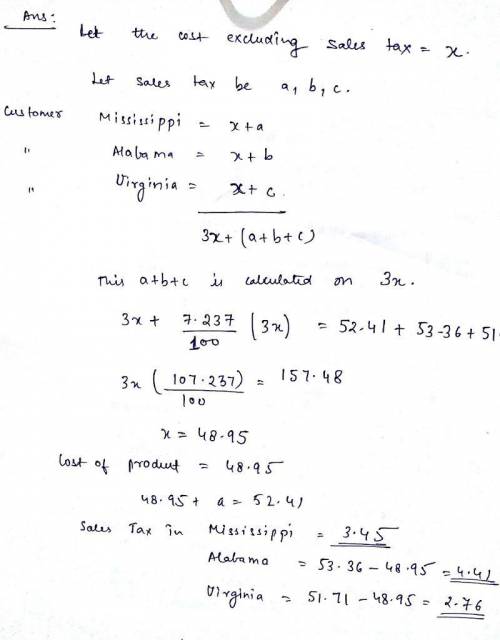

Problem 12-15 in mississippi, a customer pays $52.41 for a product (including ms state sales tax). in alabama, a customer pays $53.36 for the same product. in virginia, the customer pays $51.71 for the same product. in all three states, the sticker price (price before state sales tax is added) is the same. the average sales tax of the three states is 7.237%. determine the sales tax in each state and the cost of the product from the information given. express your answers in percent for sales tax and in dollars and cents for cost. (do not include the $ or % symbol in your answer online, only the final value with two decimal places.) (read the online version of this question carefully; it will ask for one of the values you found in a series of four questions.)

Answers: 2

Another question on Business

Business, 22.06.2019 05:30

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 23.06.2019 03:00

In each of the cases below, assume division x has a product that can be sold either to outside customers or to division y of the same company for use in its production process. the managers of the divisions are evaluated based on their divisional profits. case a b division x: capacity in units 200,000 200,000 number of units being sold to outside customers 200,000 160,000 selling price per unit to outside customers $ 90 $ 75 variable costs per unit $ 70 $ 60 fixed costs per unit (based on capacity) $ 13 $ 8 division y: number of units needed for production 40,000 40,000 purchase price per unit now being paid to an outside supplier $ 86 $ 74 required: 1. refer to the data in case a above. assume in this case that $3 per unit in variable selling costs can be avoided on intracompany sales. a. what is the lowest acceptable transfer price from the perspective of the selling division? b. what is the highest acceptable transfer price from the perspective of the buying division? c. what is the range of acceptable transfer prices (if any) between the two divisions? if the managers are free to negotiate and make decisions on their own, will a transfer probably take place?

Answers: 3

Business, 23.06.2019 07:40

In the short-run, marginal costs are equal to the change in variable costs as output changes. ( mc = change in variable cost / change in quantity) assume that capital is fixed in the short-run. (a) start with the equation for marginal cost and derive an equation that relates marginal cost of production to the cost and productivity of labor. (b) draw a standard looking short-run marginal cost curve and use the equation you derived to explain its shape.

Answers: 2

You know the right answer?

Problem 12-15 in mississippi, a customer pays $52.41 for a product (including ms state sales tax). i...

Questions

English, 26.10.2020 18:20

Mathematics, 26.10.2020 18:20

Mathematics, 26.10.2020 18:20

Mathematics, 26.10.2020 18:20

Arts, 26.10.2020 18:20

Biology, 26.10.2020 18:20

Biology, 26.10.2020 18:20

History, 26.10.2020 18:20

Mathematics, 26.10.2020 18:20

History, 26.10.2020 18:20

English, 26.10.2020 18:20

Mathematics, 26.10.2020 18:20