Business, 15.01.2020 02:31 williamsa24mr238org

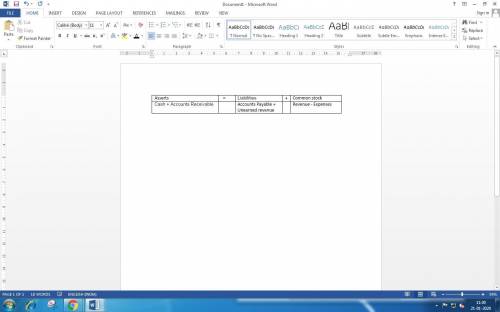

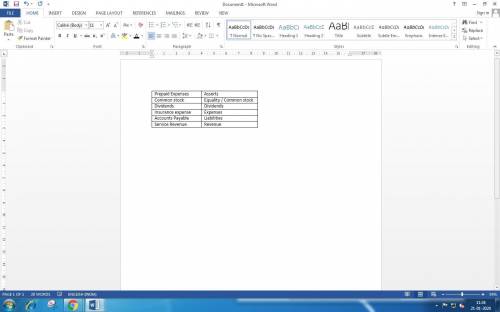

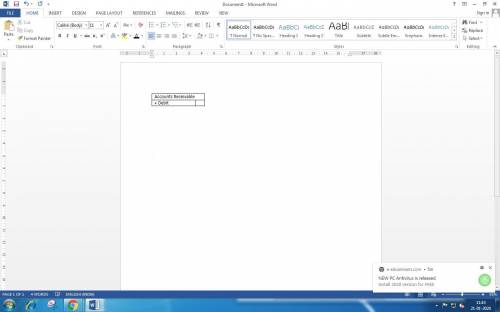

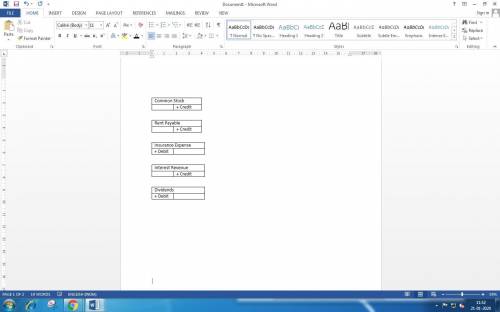

Drag the account types to form the expanded accounting equation. begin the equity section with contributed capital + retained earnings. then, identify whether the item increases, '+', or decreases, '-', equity. common accounts receivable cash dividends revenues expenses assets stock unearned revenues accounts liabilities payable 2 enter the missing value to balance the equation. e25,000 38,000 38,000 35,000. 28,000 22,000 30,000-48,000 +31,000 2,000 - 39,000 32.000 25,000 31.000 39,000 3 identify the part of the expanded accounting equation for each account title. prepaid insurance common stock dividends insurance expense accounts payable service revenue 4 build a t-account for each account title. label the dr (debit), cr (credit), nb (normal balance), and "+" or "-". credit debit normal balance accounts receivable dividends common stock + + + + insurance expense rent payable interest revenue + + + + + + using the expanded accounting equation, calculate and enter the answers for each question. you will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions. liabilities assets beginning of year: $27,000 $15,000 end of year: $60.000 $27,000 1) what is the equity at the beginning of the year? 2) what is the equity at the end of the year? ending equity beginning equity 3) if the company issues common stock of $6,300 and pay dividends of $37,300, how much is net income (loss)? 4) if net income is $1,100 and dividends are $6,000, how much is common stock? net income (loss) common stock 5) if the company issues common stock of $19,600 and net income is $19,100, how much is dividends? 6) if the company issues common stock of $42,900 and pay dividends of $3,400, how much is net income (loss)? dividends net income (loss)

Answers: 1

Another question on Business

Business, 22.06.2019 01:20

All of the industries and businesses in the country of marksenia are privately owned and sell products at different prices that are not controlled by the government or any other organizational body. consumers in marksenia are free to buy as much of the products as they like from the businesses they want. the country of marksenia has a

Answers: 1

Business, 22.06.2019 14:20

Jaynet spends $50,000 per year on painting supplies and storage space. she recently received two job offers from a famous marketing firm – one offer was for $95,000 per year, and the other was for $120,000. however, she turned both jobs down to continue a painting career. if jaynet sells 35 paintings per year at a price of $6,000 each: a. what are her accounting profits? b. what are her economic profits?

Answers: 1

Business, 22.06.2019 20:40

Answer the questions about keynesian theory, market economics, and government policy. keynes believed that there were "sticky" wages and that recessions are caused by increases in prices. decreases in supply. decreases in aggregate demand (ad). increases in unemployment. keynes believed the government should increase ad through increased government spending, but not tax cuts. control wages to increase employment because of sticky wages. increase employment through tax cuts only. increase as through tax cuts. increase ad through either increased government spending or tax cuts. intervene when individual markets fail by controlling prices and production.

Answers: 2

Business, 23.06.2019 03:20

Milden company has an exclusive franchise to purchase a product from the manufacturer and distribute it on the retail level. as an aid in planning, the company has decided to start using a contribution format income statement. to have data to prepare such a statement, the company has analyzed its expenses and has developed the following cost formulas: cost cost formula cost of good sold $35 per unit sold advertising expense $210,000 per quarter sales commissions 6% of sales shipping expense ? administrative salaries $145,000 per quarter insurance expense $9,000 per quarter depreciation expense $76,000 per quarter management has concluded that shipping expense is a mixed cost, containing both variable and fixed cost elements. units sold and the related shipping expense over the last eight quarters follow: quarter units sold shipping expense year 1: first 10,000 $ 119,000 second 16,000 $ 175,000 third 18,000 $ 190,000 fourth 15,000 $ 164,000 year 2: first 11,000 $ 130,000 second 17,000 $ 185,000 third 20,000 $ 210,000 fourth 13,000 $ 147,000 milden company’s president would like a cost formula derived for shipping expense so that a budgeted contribution format income statement can be prepared for the next quarter. required: 1. using the high-low method, estimate a cost formula for shipping expe

Answers: 2

You know the right answer?

Drag the account types to form the expanded accounting equation. begin the equity section with contr...

Questions

Biology, 16.02.2021 23:30

History, 16.02.2021 23:30

Mathematics, 16.02.2021 23:30

Mathematics, 16.02.2021 23:30

Computers and Technology, 16.02.2021 23:30

Mathematics, 16.02.2021 23:30

Mathematics, 16.02.2021 23:30

Mathematics, 16.02.2021 23:30