Business, 11.01.2020 03:31 cxttiemsp021

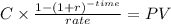

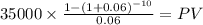

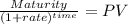

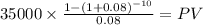

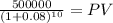

Comparing bonds issued at par, at a discount, and at a premium (ap10-2) on january 1 of this year, barnett corporation sold bonds with a face value of $500,000 and a coupon rate of 7 percent. the bonds mature in 10 years and pay interest annually on december 31. barnett uses the effective interest amortization method. ignore any tax effects. each case is independent of the other cases

required: complete the following table. the interest rates provided are the annual market rate of interest on the date the bonds were issued. case a (7%) case b (8%) case c (6%)

a. cash received at issuance

b. interest expense recorded in year 1

c. cash paid for interest in year 1 4. cash paid at maturity for bond principal

Answers: 2

Another question on Business

Business, 22.06.2019 00:30

A) plot the m1 and m2 money stock in the us from 1990-2015. (hint: you may use the data tools provided by fred.) (b) plot the nominal interest rate from 1960 to 2014. (hint: you can either use the daily interest rates for selected u.s. treasury, private money market and capital market instruments from or the effective federal funds rate fromfred.) (c) the consumer price index (cpi) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. intuitively, the cpi represents the cost of living or the average price level. plot the cpi from 1960 to 2013.(d) the inflation rate is the yearly percentage change in the average price level. in practice, we usually use the percentage change in the cpi to compute the inflation rate. plot the inflation rate from 1960 to 2013.(e) explain the difference between the ex-ante and ex-post real interest rate. use the fisher equation to compute the ex-post real interest rate. plot the nominal interest rate and the ex-post real interest rate from 1960 to 2013 in the same graph.

Answers: 3

Business, 22.06.2019 11:30

1. regarding general guidelines for the preparation of successful soups, which of the following statements is true? a. thick soups made with starchy vegetables may thin during storage. b. soups should be seasoned throughout the cooking process. c. finish a cream soup well before serving it to moderate the flavor. d. consommés take quite a long time to cool. student c incorrect

Answers: 2

Business, 22.06.2019 12:10

Profits from using currency options and futures.on july 2, the two-month futures rate of the mexican peso contained a 2 percent discount (unannualized). there was a call option on pesos with an exercise price that was equal to the spot rate. there was also a put option on pesos with an exercise price equal to the spot rate. the premium on each of these options was 3 percent of the spot rate at that time. on september 2, the option expired. go to the oanda.com website (or any site that has foreign exchange rate quotations) and determine the direct quote of the mexican peso. you exercised the option on this date if it was feasible to do so. a. what was your net profit per unit if you had purchased the call option? b. what was your net profit per unit if you had purchased the put option? c. what was your net profit per unit if you had purchased a futures contract on july 2 that had a settlement date of september 2? d. what was your net profit per unit if you sold a futures contract on july 2 that had a settlement date of september 2

Answers: 1

Business, 22.06.2019 17:00

Which represents a surplus in the market? a market price equals equilibrium price. b quantity supplied is greater than quantity demanded. c market price is less than equilibrium price. d quantity supplied equals quantity demanded.

Answers: 2

You know the right answer?

Comparing bonds issued at par, at a discount, and at a premium (ap10-2) on january 1 of this year, b...

Questions

History, 25.01.2021 18:20

English, 25.01.2021 18:20

Biology, 25.01.2021 18:20

Mathematics, 25.01.2021 18:20

Mathematics, 25.01.2021 18:20

Mathematics, 25.01.2021 18:20

English, 25.01.2021 18:20

Mathematics, 25.01.2021 18:20

English, 25.01.2021 18:20

Mathematics, 25.01.2021 18:20

Mathematics, 25.01.2021 18:20

English, 25.01.2021 18:20