Business, 08.01.2020 01:31 robertotugalanp1wlgs

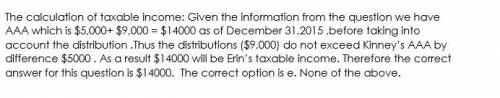

On january 1, 2015, kinney, inc., an electing s corporation, holds $5,000 of aep and $9,000 in aaa. kinney has two shareholders, eric and maria, each of whom owns 500 shares of kinney's stock. kinney's 2015 taxable income is $6,000. kinney distributes $6,000 to each shareholder on february 1 2015, and distributes another $3,000 to each shareholder shareholder on september 1.

how is erin taxed on the distribution?

a. $500 dividend income.

b. $1,000 dividend income.

c. $1,500 dividend income.

d. $3,000 dividend income.

e. none of the above.

Answers: 1

Another question on Business

Business, 21.06.2019 23:30

On september 12, ryan company sold merchandise in the amount of $5,800 to johnson company, with credit terms of 2/10, n/30. the cost of the items sold is $4,000. ryan uses the periodic inventory system and the net method of accounting for sales. on september 14, johnson returns some of the non-defective merchandise, which is restored to inventory. the selling price of the returned merchandise is $500 and the cost of the merchandise returned is $350. the entry or entries that ryan must make on september 14 is (are): multiple choice sales returns and allowances 490 accounts receivable 490 merchandise inventory 350 cost of goods sold 350 sales returns and allowances 490 accounts receivable 490 sales returns and allowances 500 accounts receivable 500 sales returns and allowances 490 accounts receivable 490 merchandise inventory 343 cost of goods sold 343 sales returns and allowances 350 accounts receivable 350

Answers: 1

Business, 22.06.2019 11:00

You are attending college in the fall and you need to purchase a computer. you must finance the purchase because your parents will not purchase it for you, and you do not have the cash on hand to purchase it. in blank #1 determine which type of credit would you use to finance your purchase (installment, non-installment, or revolving credit). (2 points) in blank #2 defend your credit choice by explaining why your financing option is the best option for you. (2 points) in blank #3 explain why you selected that credit option over the other two options available. (2 points)

Answers: 3

Business, 22.06.2019 17:30

Which of the following services will be provided by a full-service broker but not by a discount broker? i. research of potential investment opportunities ii. purchase and sale of stock at your request iii. recommendation of investments a. i and iii b. ii only c. iii only d. i, ii, and ii

Answers: 2

Business, 22.06.2019 22:30

Suppose that each country completely specializes in the production of the good in which it has a comparative advantage, producing only that good. in this case, the country that produces jeans will produce million pairs per week, and the country that produces corn will produce million bushels per week.

Answers: 1

You know the right answer?

On january 1, 2015, kinney, inc., an electing s corporation, holds $5,000 of aep and $9,000 in aaa....

Questions

Biology, 04.10.2019 22:20

Biology, 04.10.2019 22:20

Biology, 04.10.2019 22:20

Social Studies, 04.10.2019 22:20