Business, 08.01.2020 00:31 ximenareyna07

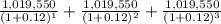

Quad enterprises is considering a new three year expansion project that requires an initial fixed asset investment of 2.32 million. the fixed asset will be depreciated straight line to zero over its three year tax life, after which time it will be worthless. the project estimated to generate 1.735 million in annual sales, with costs of 650,000. the tax rate is 21 percent and the required return on the project is 12 percent. what is the project's npv?

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

In most states, a licensee must provide a(n) of any existing agency relationships to all parties

Answers: 3

Business, 22.06.2019 06:30

Select all that apply. what do opponents of minimum wage believe are the results of minimum wage? increases personal income results in job shortages causes unemployment raises prices of goods

Answers: 1

Business, 22.06.2019 11:50

Christopher kim, cfa, is a banker with batts brothers, an investment banking firm. kim follows the energy industry and has frequent contact with industry executives. kim is contacted by the ceo of a large oil and gas corporation who wants batts brothers to underwrite a secondary offering of the company's stock. the ceo offers kim the opportunity to fly on his private jet to his ranch in texas for an exotic game hunting expedition if kim's firm can complete the underwriting within 90 days. according to cfa institute standards of conduct, kim: a) may accept the offer as long as he discloses the offer to batts brothers.b) may not accept the offer because it is considered lavish entertainment.c) must obtain written consent from batts brothers before accepting the offer.

Answers: 1

Business, 22.06.2019 12:10

In year 1, the bennetts' 25-year-old daughter, jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. in previous years, jane has never worked and her parents have always been able to claim her as a dependent. in year 1, a kind neighbor offers to pay for all of jane's educational and living expenses. which of the following statements is most accurate regarding whether jane's parents would be allowed to claim an exemption for jane in year 1 assuming the neighbor pays for all of jane's support? a.no, jane must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative.b.yes, because she is a full-time student and does not provide more than half of her own support, jane is considered her parent's qualifying child.c.no, jane is too old to be considered a qualifying child and fails the support test of a qualifying relative.d.yes, because she is a student, her absence is considered as "temporary." consequently she meets the residence test and is a considered a qualifying child of the bennetts.

Answers: 2

You know the right answer?

Quad enterprises is considering a new three year expansion project that requires an initial fixed as...

Questions

Biology, 26.06.2021 03:30

Spanish, 26.06.2021 03:30

Computers and Technology, 26.06.2021 03:30

Mathematics, 26.06.2021 03:30

Mathematics, 26.06.2021 03:30

Mathematics, 26.06.2021 03:30

Mathematics, 26.06.2021 03:30

Mathematics, 26.06.2021 03:40

Mathematics, 26.06.2021 03:40

- 2,320,000

- 2,320,000