Business, 31.12.2019 05:31 bugsbunny27

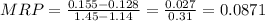

Suppose you observe the following situation: security beta expected return pete corp. 1.45 .155 repete co. 1.14 .128 assume these securities are correctly priced. based on the capm, what is the expected return on the market?

Answers: 1

Another question on Business

Business, 22.06.2019 11:20

In 2000, campbell soup company launched an ad campaign that showed prepubescent boys offering soup to prepubescent girls. the girls declined because they were concerned about their calorie intake. the boys explained that “lots of campbell’s soups are low in calories,” which made them ok for the girls to eat. the ads were pulled after parents expressed concern. why were parents worried? i

Answers: 2

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

Business, 22.06.2019 21:10

Which of the following statements is (are) true? i. free entry to a perfectly competitive industry results in the industry's firms earning zero economic profit in the long run, except for the most efficient producers, who may earn economic rent. ii. in a perfectly competitive market, long-run equilibrium is characterized by lmc < p < latc. iii. if a competitive industry is in long-run equilibrium, a decrease in demand causes firms to earn negative profit because the market price will fall below average total cost.

Answers: 3

Business, 22.06.2019 21:20

Which of the following best explains why large companies pay less for goods from wholesalers? a. large companies are able to pay for the goods they purchase in cash. b. large companies are able to increase the efficiency of wholesale production. c. large companies can buy all or most of a wholesaler's stock. d. large companies have better-paid employees who are better negotiators.

Answers: 2

You know the right answer?

Suppose you observe the following situation: security beta expected return pete corp. 1.45 .155 rep...

Questions

English, 31.03.2021 23:20

English, 31.03.2021 23:20

Spanish, 31.03.2021 23:20

Mathematics, 31.03.2021 23:20

Mathematics, 31.03.2021 23:20

Physics, 31.03.2021 23:20

Mathematics, 31.03.2021 23:20

Mathematics, 31.03.2021 23:20

History, 31.03.2021 23:20

Mathematics, 31.03.2021 23:20

SAT, 31.03.2021 23:20