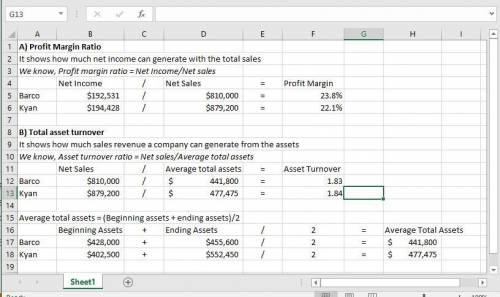

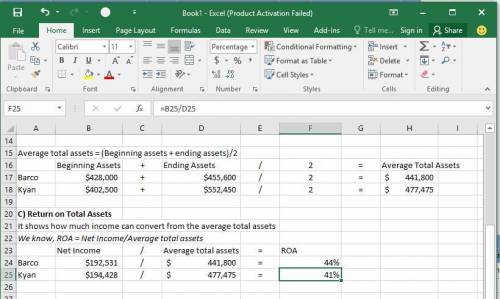

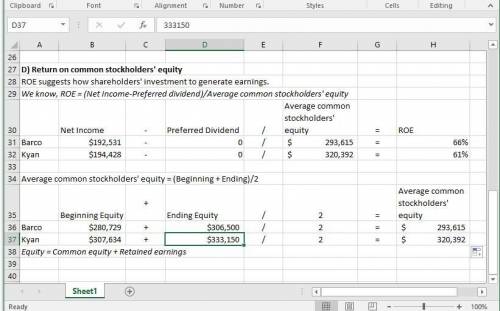

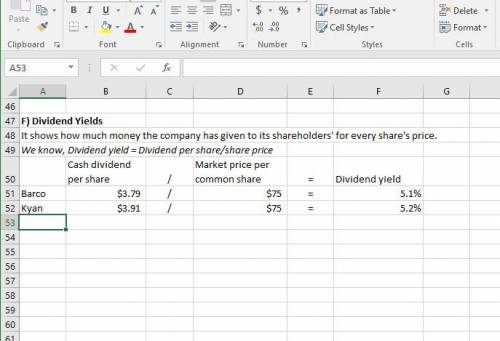

For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on common stockholders’ equity. assuming that each company’s stock can be purchased at $75 per share, compute their (e) price-earnings ratios and (f) dividend yields. (do not round intermediate calculations. round your answers to 2 decimal places.) 2b. identify which company’s stock you would recommend as the better investment. summary information from the financial statements of two companies competing in the same industry follows barco kyan barco kyan company company company company 879,200 646,500 data from the current year-end balance sheets data from the current year's income statement assets sales $ 810,000 $ $ 36,000 $ 18,500 36,400 593,100 8,800 15,569 cash cost of goods sold 53,400 interest expense accounts receivable, net current notes receivable (trade) merchandise inventory prepaid expenses plant assets, net 14,000 24,272 192,53 194,428 4.50 3.91 10,000 income tax expense 7,200 84,940 138,500 net income 5,800 6,950basic earnings per share cash dividends per share 4.38 3.79 300,000 310,400 552,450 total assets $455,640 $ beginning-of-year balance sheet data accounts receivable, net liabilities and equity current liabilities long-term notes payable $ 28,800 $ 51,200 0 59,600 105,400 $ 67,340 $102,300 current notes receivable (trade) 0 81,800 117,000merchandise inventory 402,500 428,000 common stock, $5 par value retained earnings 220,000 216,000 total assets 117,150 552,450 86,500 common stock, $5 par value 220,000 216,000 total liabilities and equity $455,640 $ retained earnings 60,729 91,634

Answers: 1

Another question on Business

Business, 22.06.2019 03:30

Diversified semiconductors sells perishable electronic components. some must be shipped and stored in reusable protective containers. customers pay a deposit for each container received. the deposit is equal to the container’s cost. they receive a refund when the container is returned. during 2018, deposits collected on containers shipped were $856,000. deposits are forfeited if containers are not returned within 18 months. containers held by customers at january 1, 2018, represented deposits of $587,000. in 2018, $811,000 was refunded and deposits forfeited were $41,000. required: 1. prepare the appropriate journal entries for the deposits received and returned during 2018. 2. determine the liability for refundable deposits to be reported on the december 31, 2018, balance sheet.

Answers: 1

Business, 22.06.2019 03:30

Tiana daniels enterprise’s trial balance as at december 31, 2016 did not balance. on february 15, 2017 the following errors were detected: errorsi. water rates had been undercast by $2, 000. ii. a cheque paid to yvonne walch of $2, 680 had been posted to the credit side of her account. iii. discount received total of $1, 260 had been posted to the debit side of the discount allowed account as $1, 620. iv. rent paid in the amount of $24, 000 had been posted to the credit of the rent received account. v. wayne returned goods valuing $1, 680 to daniels enterprise but had been completely omitted from the books. required: 1. prepare the journal entries to correct the errors. (narrations required) 14.5 marks 2. prepare the suspense account showing clearly the original trial balance error. 8 marks

Answers: 2

Business, 22.06.2019 12:00

Need today! will get brainliest for right answer! compare and contrast absolute advantage and comparative advantage.

Answers: 1

Business, 22.06.2019 19:40

The martinez legal firm (mlf) recently acquired a smaller competitor, miller and associates, which specializes in issues not previously covered by mlf, such as land use and intellectual property cases. given the increase in the firm's size and complexity, it is likely that its internal transaction costs willa. decrease. b. increase. c. become external transaction costs. d. be eliminated.

Answers: 3

You know the right answer?

For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on tota...

Questions

Mathematics, 17.12.2020 01:20

Mathematics, 17.12.2020 01:20

History, 17.12.2020 01:20

Mathematics, 17.12.2020 01:20

Physics, 17.12.2020 01:20

History, 17.12.2020 01:20

Geography, 17.12.2020 01:20

Social Studies, 17.12.2020 01:20

Spanish, 17.12.2020 01:20

Mathematics, 17.12.2020 01:20

English, 17.12.2020 01:20

Social Studies, 17.12.2020 01:20

Mathematics, 17.12.2020 01:20