Business, 24.12.2019 19:31 thegoat3180

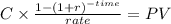

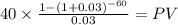

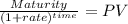

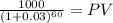

Acompany has an 8% bond that has a face value of $1,000 and matures in 30 years. assume that coupon payments are made semi-annually. the bonds are callable after 15 years at 108% of par value. what is the value of the bond if rates drop immediately to 6%? a. $1,277b. $2,192c. $1,452d. $1,229e. $602

Answers: 3

Another question on Business

Business, 21.06.2019 22:50

The following data pertains to activity and costs for two months: june july activity level in 10,000 12,000 direct materials $16,000 $ ? fixed factory rent 12,000 ? manufacturing overhead 10,000 ? total cost $38,000 $42,900 assuming that these activity levels are within the relevant range, the manufacturing overhead for july was: a) $10,000 b) $11,700 c) $19,000 d) $9,300

Answers: 2

Business, 22.06.2019 11:30

Buyer henry is going to accept seller shannon's $282,500 counteroffer. when will this counteroffer become a contract. a. counteroffers cannot become contracts b. when henry gives shannon notice of the acceptance c. when henry signs the counteroffer d. when shannon first made the counteroffer

Answers: 3

Business, 22.06.2019 21:30

Abond purchased for $950 was sold for $980 after one year. the interest received during the year is $25. the bond's yield is:

Answers: 1

Business, 23.06.2019 20:30

Explain the concept of borrowed equity as it relates to an event sponsor. the concept of borrowed equity is when a sponsor does something such as make the team's uniforms or pay for the event venue and in return they are able to advertise their brand during the event or on flyers and things of that nature.

Answers: 1

You know the right answer?

Acompany has an 8% bond that has a face value of $1,000 and matures in 30 years. assume that coupon...

Questions

English, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

Mathematics, 31.08.2020 03:01

English, 31.08.2020 03:01

Mathematics, 31.08.2020 04:01

History, 31.08.2020 04:01