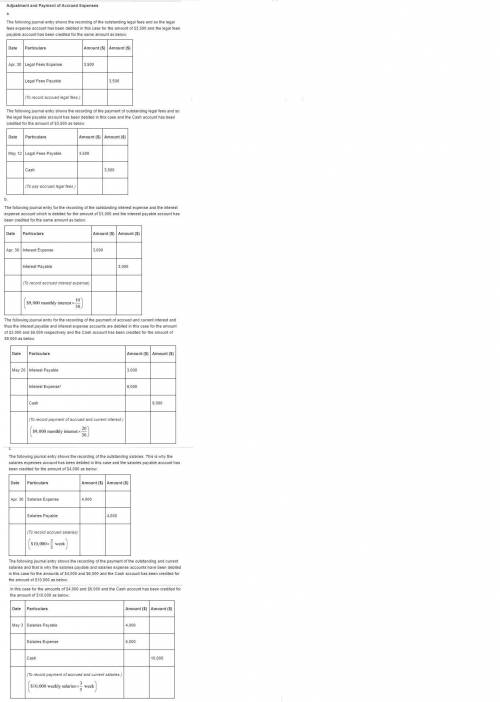

A. on april 1, the company retained an attorney for a flat monthly fee of $3,500. payment for april legal services was made by the company on may 12.b. a $900,000 note payable requires 12% annual interest, or $9,000, to be paid at the 20th day of each month. the interest was last paid on april 20, and the next payment is due on may 20. as of april 30, $3,000 of interest expense has accrued. c. total weekly salaries expense for all employees is $10,000. this amount is paid at the end of the day on friday of each five-day workweek. april 30 falls on a tuesday, which means that the employees had worked two days since the last payday. the next payday is may 3. required: 1. the above three separate situations require adjusting journal entries to prepare financial statements as of april 30. 2. for each situation, present both: i. the april 30 adjusting entry. ii. the subsequent entry during may to record payment of the accrued expenses.

Answers: 1

Another question on Business

Business, 21.06.2019 17:50

When borrowers want funding to pay for different projects, they go to the loanable funds market and acquire funds through either indirect finance or direct finance. below, you are given five different scenarios. is each an example of direct finance or indirect finance?

Answers: 2

Business, 21.06.2019 23:30

Minneapolis federal reserve bank economist edward prescott estimates the elasticity of the u.s. labor supply to be 3. given this elasticity, what would be the impact of funding the social security program with tax increases on the number of hours worked and on the amount of taxes collected to fund social security?

Answers: 2

Business, 22.06.2019 10:30

On july 1, oura corp. made a sale of $ 450,000 to stratus, inc. on account. terms of the sale were 2/10, n/30. stratus makes payment on july 9. oura uses the net method when accounting for sales discounts. ignore cost of goods sold and the reduction of inventory. a. prepare all oura's journal entries. b. what net sales does oura report?

Answers: 2

Business, 22.06.2019 19:40

The common stock of ncp paid $1.35 in dividends last year. dividends are expected to grow at an annual rate of 5.30 percent for an indefinite number of years. a. if ncp's current market price is $22.57 per share, what is the stock's expected rate of return? b. if your required rate of return is 7.3 percent, what is the value of the stock for you? c. should you make the investment? a. if ncp's current market price is $22.57 per share, the stock's expected rate of return is

Answers: 3

You know the right answer?

A. on april 1, the company retained an attorney for a flat monthly fee of $3,500. payment for april...

Questions

English, 02.12.2020 21:10

Mathematics, 02.12.2020 21:10

Geography, 02.12.2020 21:10

Mathematics, 02.12.2020 21:10

History, 02.12.2020 21:10

Mathematics, 02.12.2020 21:10

Mathematics, 02.12.2020 21:10

Mathematics, 02.12.2020 21:10