Business, 21.12.2019 06:31 cdjeter12oxoait

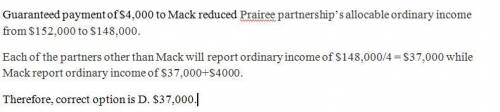

Prairie partnership has four equal partners, dodd, crank, pick, and mack. each of the partners had a tax basis of $320,000 as of january 1, 20x5. prairie’s 20x5 ordinary business income was $152,000 before deducting any guaranteed payments to the partners. during 20x5, prairie paid mack guaranteed payments of $4,000 for deductible services rendered. during 20x5, each of the four partners took a distribution of $50,000. what is mack’s tax basis in prairie on december 31, 20x5?

Answers: 2

Another question on Business

Business, 22.06.2019 05:30

Identify the three components of a family's culture and provide one example from your own experience

Answers: 2

Business, 22.06.2019 05:50

Match the steps for conducting an informational interview with the tasks in each step.

Answers: 1

Business, 22.06.2019 09:40

Catherine de bourgh has one child, anne, who is 18 years old at the end of the year. anne lived at home for seven months during the year before leaving home to attend state university for the rest of the year. during the year, anne earned $6,000 while working part time. catherine provided 80 percent of anne's support and anne provided the rest. which of the following statements regarding whether anne is catherine's qualifying child for the current year is correct? a.anne is a qualifying child of catherine.b.anne is not a qualifying child of catherine because she fails the gross income test.c.anne is not a qualifying child of catherine because she fails the residence test.d.anne is not a qualifying child of catherine because she fails the support test.

Answers: 2

Business, 22.06.2019 10:20

Sye chase started and operated a small family architectural firm in 2016. the firm was affected by two events: (1) chase provided $25,000 of services on account, and (2) he purchased $2,800 of supplies on account. there were $250 of supplies on hand as of december 31, 2016. record the two transactions in the accounts. record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. post the entries in the t-accounts and prepare a post-closing trial balance.

Answers: 1

You know the right answer?

Prairie partnership has four equal partners, dodd, crank, pick, and mack. each of the partners had a...

Questions

Advanced Placement (AP), 23.04.2021 05:20

Mathematics, 23.04.2021 05:20

Mathematics, 23.04.2021 05:20

English, 23.04.2021 05:20

Mathematics, 23.04.2021 05:20

Mathematics, 23.04.2021 05:20

Mathematics, 23.04.2021 05:20

Law, 23.04.2021 05:20