Business, 21.12.2019 02:31 4300224102

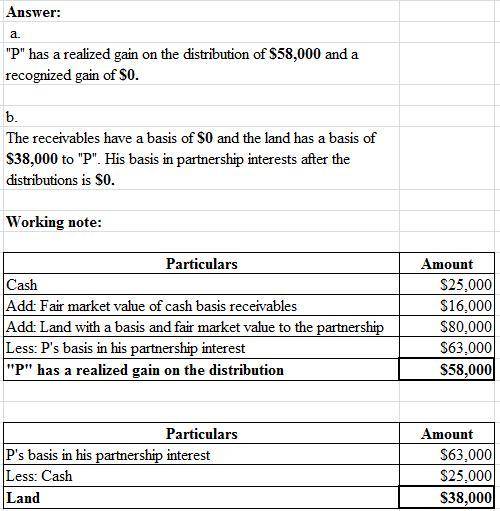

Pablo has a $63,000 basis in his partnership interest. on may 9 of the current tax year, the partnership distributes to him, in a proportionate nonliquidating distribution, cash of $25,000, cash basis receivables with an inside basis of $0 and a fair market value of $16,000, and land with a basis and fair market value to the partnership of $80,000.

if an amount is zero, enter "0".

a. how much is pablo’s realized and recognized gain on the distribution?

pablo has a realized gain on the distribution of $ and a recognized gain of $

b. what is pablo’s basis in the receivables, land, and partnership interest following the distribution?

the receivables have a basis of $ and the land has a basis of $ to pablo. his basis in partnership interests after the distributions is $

Answers: 3

Another question on Business

Business, 22.06.2019 00:10

Which of the following is a problem for the production of public goods?

Answers: 2

Business, 22.06.2019 06:30

The larger the investment you make, the easier it will be to: get money from other sources. guarantee cash flow. buy insurance. streamline your products.

Answers: 3

Business, 22.06.2019 18:00

Your subscription to investing wisely weekly is about to expire. you plan to subscribe to the magazine for the rest of your life, and you can renew it by paying $85 annually, beginning immediately, or you can get a lifetime subscription for $620, also payable immediately. assuming that you can earn 6.0% on your funds and that the annual renewal rate will remain constant, how many years must you live to make the lifetime subscription the better buy?

Answers: 2

Business, 22.06.2019 18:10

Consumers who participate in the sharing economy seem willing to interact with total strangers. despite safety and privacy concerns, what do you think is the long-term outlook for this change in the way we think about interacting with people whom we don't know? how can businesses to diminish worries some people may have about these practices?

Answers: 1

You know the right answer?

Pablo has a $63,000 basis in his partnership interest. on may 9 of the current tax year, the partner...

Questions

History, 27.07.2019 07:00

Biology, 27.07.2019 07:00

Social Studies, 27.07.2019 07:00

Biology, 27.07.2019 07:00