Business, 18.12.2019 17:31 22moneymorgan

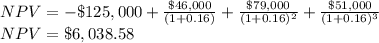

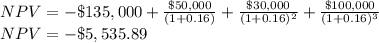

You are considering two independent projects. project a has an initial cost of $125,000 and cash inflows of $46,000, $79,000, and $51,000 for years 1 to 3, respectively. project b costs $135,000 with expected cash inflows for years 1 to 3 of $50,000, $30,000, and $100,000, respectively. the required return for both projects is 16 percent. based on irr, you should:

a. accept both projects.

b. accept project a and reject project b.

c. accept project b and reject project a.

d. reject both projects.

e. accept either one of the projects, but not both

Answers: 3

Another question on Business

Business, 22.06.2019 11:20

You decided to charge $100 for your new computer game, but people are not buying it. what could you do to encourage people to buy your game?

Answers: 1

Business, 22.06.2019 17:30

Which curve shows increasing opportunity cost as you give up more of one option? demand curve bow-shaped curve yield curve indifference curve

Answers: 3

Business, 22.06.2019 22:00

As a general rule, when accountants calculate profit they account for explicit costs but usually ignorea. certain outlays of money by the firm.b. implicit costs.c. operating costs.d. fixed costs.

Answers: 2

Business, 22.06.2019 22:40

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. use the irr decision to evaluate this project; should it be accepted or rejected

Answers: 3

You know the right answer?

You are considering two independent projects. project a has an initial cost of $125,000 and cash inf...

Questions

English, 26.08.2020 21:01

Mathematics, 26.08.2020 21:01

History, 26.08.2020 21:01

Chemistry, 26.08.2020 21:01

Mathematics, 26.08.2020 21:01

Physics, 26.08.2020 21:01

History, 26.08.2020 21:01