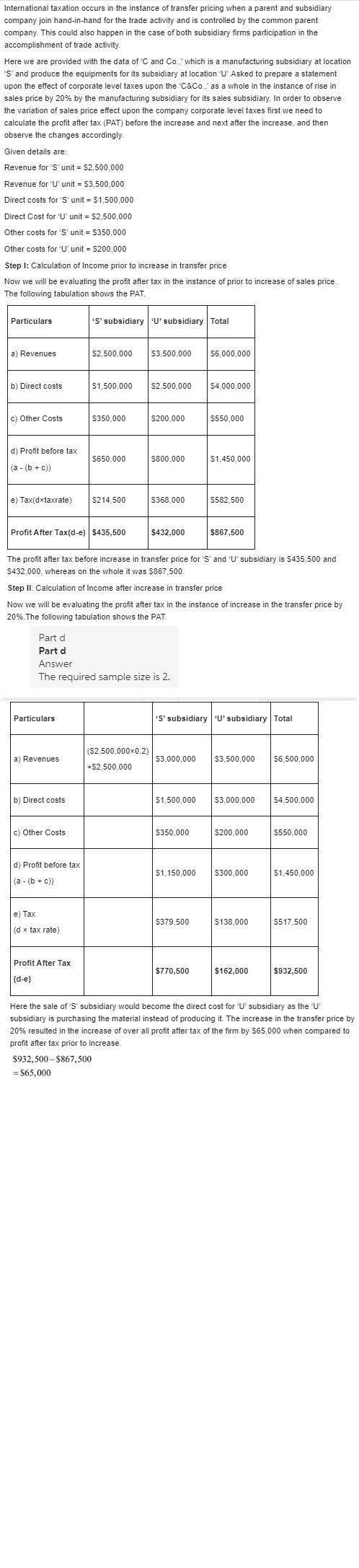

Transfer pricing; international taxation crain company has a manufacturing subsidiary in singapore that produces high- end exercise equipment for u. s. consumers. the manufacturing subsidiary has total manufacturing costs of $1,500,ooo, plus general and administrative expenses of $350,000. the manufacturing unit sells the equipment for $2,500,000 to the u. s. marketing subsidiary, which sells it to the final consumer for an aggregate of the sales subsidiary has total marketing, general, and administrative costs of $200,000. assume that singapore has a corporate tax rate of 33% and that the u. s. tax rate is 46%. assume that no tax treaties or other special tax treatments apply.

required: what is the effect on crain company's total corporate-level taxes if the manufacturing subsidiary raises its price to the sales subsidiary by 20%?

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 20:00

Later movers do not face: entrenched competitors. reduced uncertainty over technologies. high growth markets. lower market uncertainty.

Answers: 3

Business, 22.06.2019 22:40

Which of the following will not cause the consumption schedule to shift? a) a sharp increase in the amount of wealth held by households b) a change in consumer incomes c) the expectation of a recession d) a growing expectation that consumer durables will be in short supply

Answers: 1

Business, 22.06.2019 23:40

Joint cost cheyenne, inc. produces three products from a common input. the joint costs for a typical quarter follow: direct materials $45,000 direct labor 55,000 overhead 60,000 the revenues from each product are as follows: product a $75,000 product b 80,000 product c 30,000 management is considering processing product a beyond the split-off point, which would increase the sales value of product a to $116,000. however, to process product a further means that the company must rent some special equipment costing $17,500 per quarter. additional materials and labor also needed would cost $12,650 per quarter. a. what is the gross profit currently being earned by the three products for one quarter? $answer b. what is the effect on quarterly profits if the company decides to process product a further? $answer

Answers: 2

You know the right answer?

Transfer pricing; international taxation crain company has a manufacturing subsidiary in singapore...

Questions

Mathematics, 02.03.2021 20:50

Biology, 02.03.2021 20:50

Mathematics, 02.03.2021 20:50

History, 02.03.2021 20:50

English, 02.03.2021 20:50