Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 25%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00.

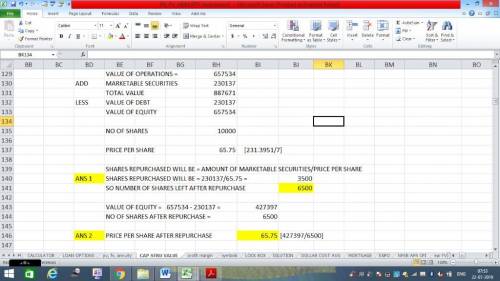

refer to the data for pennewell publishing inc. (pp). assume that pp is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity. this results in a weighted average cost of capital equal to 9.125% and a new value of operations of $657,534. assume pp raises $230,137 in new debt and purchases t-bills to hold until it makes the stock repurchase. pp then sells the t-bills and uses the proceeds to repurchase stock. how many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

remaining shares; p post

a. 7,000; $74.26

b. 6,500; $65.75

c. 7,500; $86.18

d. 6,959; $58.03

e. 6,649; $63.48

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

3. describe the purpose of the sec. (1-4 sentences. 2.0 points)

Answers: 3

Business, 22.06.2019 11:00

The role of the credit department includes: a. evaluating customers' credit applications to determine whether they meet the company's approval standards. b. approving all credit applications in order to avoid losing sales. c. collecting cash from customers. d. following unwritten approval standards for processing customers' credit applications.

Answers: 2

Business, 22.06.2019 16:30

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

Business, 23.06.2019 00:30

Braden’s ice cream shop is losing business. he knows that customers are no longer choosing his product because a competing product has become less expensive, yet he has refused to lower his prices. what has happened to braden’s business?

Answers: 1

You know the right answer?

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings...

Questions

Biology, 20.03.2021 17:40

Chemistry, 20.03.2021 17:40

History, 20.03.2021 17:40

Geography, 20.03.2021 17:40

Physics, 20.03.2021 17:40

World Languages, 20.03.2021 17:40

Mathematics, 20.03.2021 17:40

English, 20.03.2021 17:40

Mathematics, 20.03.2021 17:50

Mathematics, 20.03.2021 17:50