Monfett manufacturing earned operating income last year as shown in the following income

state...

Business, 18.12.2019 02:31 alexandrecarmene

Monfett manufacturing earned operating income last year as shown in the following income

statement:

sales $620,000

cost of goods sold 316,000

gross margin $304,000

selling and administrative expense 219,000

operating income $ 85,000

less: income taxes (at 40%) 34,000

net income $ 51,000

at the beginning of the year, the value of operating assets was $263,000. at the end of the year, the value of operating assets was $336,000. monfett manufacturing requires a minimum rate of return of 15%. total capital employed equal $350,000 and actual cost of capital is 6%.

required:

calculate the following:

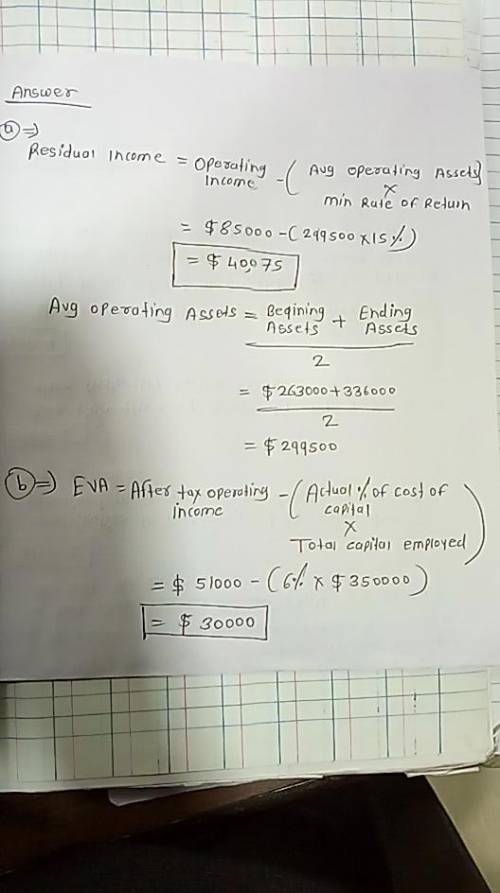

1.residual income

2.ev

Answers: 2

Another question on Business

Business, 21.06.2019 18:30

Which stroke of the four-stroke cycle is shown in the above figure? a. power b. compression c. exhaust d. intake

Answers: 2

Business, 22.06.2019 00:50

cranium, inc., purchases term papers from an overseas supplier under a continuous review system. the average demand for a popular mode is 300 units a day with a standard deviation of 30 units a day. it costs $60 to process each order and there is a five−day lead−time. the holding cost for a paper is $0.25 per year and the company policy is to maintain a 98% service level. cranium operates 200 days per year.what is the reorder point r to satisfy a 98% cycleminus−service level? a. greater than 1,700 unitsb. greater than 1,600 units but less than or equal to 1,700 unitsc. greater than 1,500 units but less than or equal to 1,600 unitsd. less than or equal to 1,500 units

Answers: 1

Business, 22.06.2019 19:00

For each of the following cases determine the ending balance in the inventory account. (hint: first, determine the total cost of inventory available for sale. next, subtract the cost of the inventory sold to arrive at the ending balance.)a. jill’s dress shop had a beginning balance in its inventory account of $40,000. during the accounting period jill’s purchased $75,000 of inventory, returned $5,000 of inventory, and obtained $750 of purchases discounts. jill’s incurred $1,000 of transportation-in cost and $600 of transportation-out cost. salaries of sales personnel amounted to $31,000. administrative expenses amounted to $35,600. cost of goods sold amounted to $82,300.b. ken’s bait shop had a beginning balance in its inventory account of $8,000. during the accounting period ken’s purchased $36,900 of inventory, obtained $1,200 of purchases allowances, and received $360 of purchases discounts. sales discounts amounted to $640. ken’s incurred $900 of transportation-in cost and $260 of transportation-out cost. selling and administrative cost amounted to $12,300. cost of goods sold amounted to $33,900.a& b. cost of goods avaliable for sale? ending inventory?

Answers: 1

Business, 22.06.2019 22:20

Who owns a renter-occupied apartment? a. the government b. a landlord c. the resident d. a cooperative

Answers: 1

You know the right answer?

Questions

Physics, 29.07.2021 05:20

Mathematics, 29.07.2021 05:20

History, 29.07.2021 05:20

Mathematics, 29.07.2021 05:20

Mathematics, 29.07.2021 05:20

Mathematics, 29.07.2021 05:30

Mathematics, 29.07.2021 05:30

Mathematics, 29.07.2021 05:30