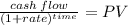

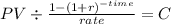

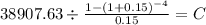

Your company operates a fleet of light trucks that are used to provide contract delivery services. as the engineering and technical manager, you are analyzing the purchase of 55 new trucks as an addition to the fleet. these trucks would be used for a new contract the sales staff is trying to obtain. if purchased, the trucks would cost $21,200 each; estimated use is 20,000 miles per year per truck; estimated operation and maintenance and other related expenses (year-zero dollars) are $0.45 per mile, which is forecasted to increase at the rate of 5% per year; and the trucks are macrs (gds) three-year property class assets. the analysis period is four years; t= 25%; marr = 15% per year (after taxes; includes an inflation component); and the estimated mv at the end of four years (in year-zero dollars) is 35% of the purchase price of the vehicles. this estimate is expected to increase at the rate of 2% per year. based on an after-tax analysis, what is the uniform annual revenue required by your company from the contract to justify these expenditures before any profit is considered? this calculated amount for annual revenue is the breakeven point between purchasing the trucks and which other alternative?

Answers: 1

Another question on Business

Business, 21.06.2019 16:10

You are at a holiday dinner with your family. your relative makes the argument that the u.s. economy is resurgent and has recovered from the great recession of 2007 – 2009. economic growth, as measured by gdp, has been increasing from one quarter to the next. you beg to differ. how would you structure your argument with your relative? hint: you should think about two things, the accuracy of gdp measures, and whether gdp should be considered a comprehensive measure of a countries well-being.

Answers: 3

Business, 22.06.2019 10:50

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

You know the right answer?

Your company operates a fleet of light trucks that are used to provide contract delivery services. a...

Questions

History, 16.03.2022 17:40

Biology, 16.03.2022 17:40

Computers and Technology, 16.03.2022 17:40

Computers and Technology, 16.03.2022 17:40

Mathematics, 16.03.2022 17:40

SAT, 16.03.2022 17:40

Mathematics, 16.03.2022 17:40

Mathematics, 16.03.2022 17:40