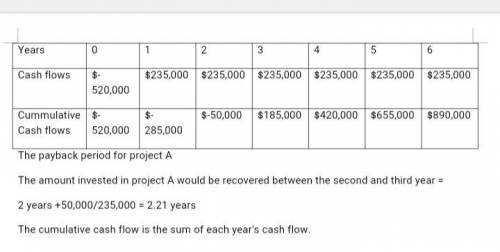

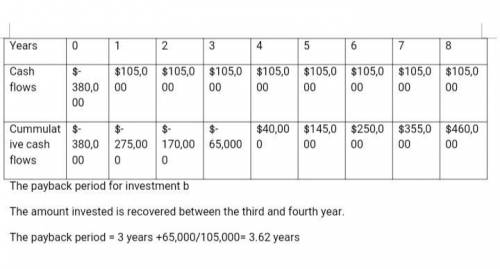

Compute the payback period for each of these two separate investments (round the payback period to two decimals): a. a new operating system for an existing machine is expected to cost $520,000 and have a useful life of six years. the system yields an incremental after-tax income of $150,000 each year after deducting its straight-line depreciation. the predicted salvage value of the system is $10,000.b. a machine costs $380,000, has a $20,000 salvage value, is expected to last eight years, and will generate an after-tax income of $60,000 per year after straight-line depreciation. nb: i need a detailed and well explained answer. full points would be awarded for a detailed and well explained answer

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Andrew cooper decides to become a part owner of a corporation. as a part owner, he expects to receive a profit as payment because he has assumed the risk of - serious inflation eroding the purchasing power of his investment.- being paid before the suppliers and employees are paid.- losing his home, car, and life savings.- losing the money he has invested in the corporation and not receiving profits.- the company giving all of the profits to local communities

Answers: 2

Business, 21.06.2019 22:50

The following data pertains to activity and costs for two months: june july activity level in 10,000 12,000 direct materials $16,000 $ ? fixed factory rent 12,000 ? manufacturing overhead 10,000 ? total cost $38,000 $42,900 assuming that these activity levels are within the relevant range, the manufacturing overhead for july was: a) $10,000 b) $11,700 c) $19,000 d) $9,300

Answers: 2

Business, 22.06.2019 07:40

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

You know the right answer?

Compute the payback period for each of these two separate investments (round the payback period to t...

Questions

Computers and Technology, 15.12.2020 07:30

Biology, 15.12.2020 07:30

History, 15.12.2020 07:30

Mathematics, 15.12.2020 07:30

Mathematics, 15.12.2020 07:30

Mathematics, 15.12.2020 07:40

Biology, 15.12.2020 07:40

Mathematics, 15.12.2020 07:40

Business, 15.12.2020 07:40

Mathematics, 15.12.2020 07:40

Physics, 15.12.2020 07:40