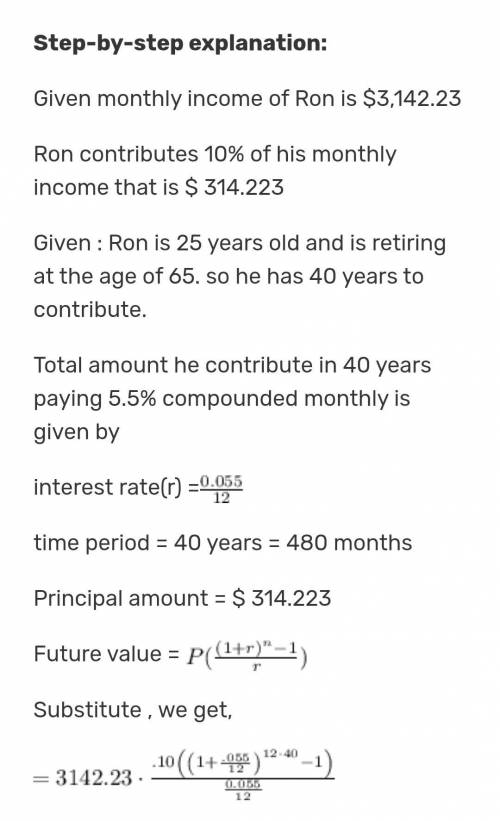

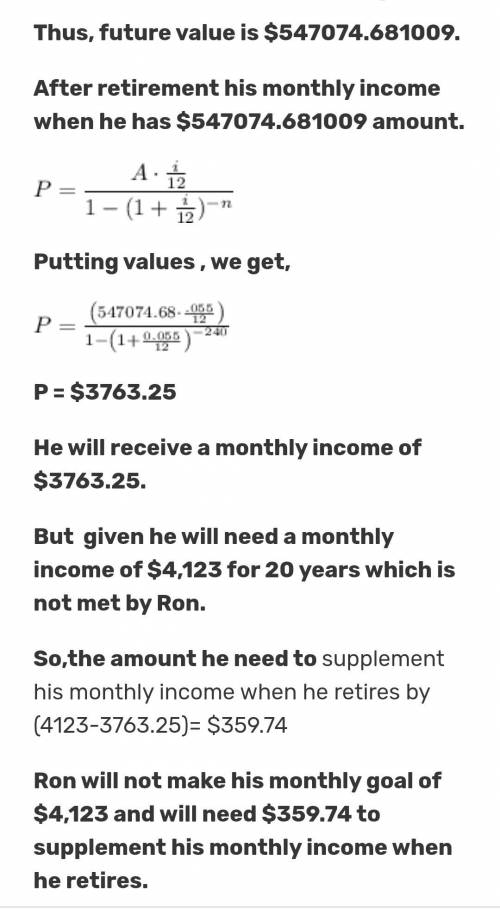

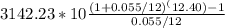

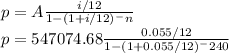

Ron is 25 years old and is retiring at the age of 65. when he retires, he will need a monthly income of $4,123 for 20 years. if ron contributes 10% of his monthly income to a 401(k) paying 5.5% compounded monthly, will he reach his goal for retirement given that his monthly income is 3,142.23? if he does not make his goal then state by what amount he will need to supplement his income. round all answers to the nearest cent. a.ron will meet his monthly goal of exactly $4,123 for retirement. b.ron will meet his monthly goal of $4,123 for retirement with an excess of $125.34.c. ron will not make his monthly goal of $4,123 and will need $359.74 to supplement his monthly income when he retires. d.ron will not make his monthly goal of $4,123 and will need $450.61 to supplement his monthly income when he retires.

Answers: 2

Another question on Business

Business, 22.06.2019 11:10

Suppose that the firm cherryblossom has an orchard they are willing to sell today. the net annual returns to the orchard are expected to be $50,000 per year for the next 20 years. at the end of 20 years, it is expected the land will sell for $30,000. calculate the market value of the orchard if the market rate of return on comparable investments is 16%.

Answers: 1

Business, 22.06.2019 19:00

Read the scenario. alfonso is 19 years old and has a high school diploma. recently, he was promoted to assistant manager at the fast-food restaurant where he has worked since the age of sixteen. his dream is to become the restaurant’s manager. what is his best option for achieving his dream? he should find another job and work his way up to a higher position. he should hope that his manager transfers to another location and that he is his replacement. he should attend classes at the local college to receive training in management. he should work hard, work longer hours, and remain assistant manager.

Answers: 2

Business, 22.06.2019 19:20

Garrett is an executive vice president at samm hardware. he researches a proposal by a larger company, maximum hardware, to combine the two companies. by analyzing past performance, conducting focus groups, and interviewing maximum employees, garrett concludes that maximum has poor profit margins, sells shoddy merchandise, and treats customers poorly. what actions should garrett and samm hardware take? a. turn down the acquisition offer and prepare to resist a hostile takeover. b. attempt a friendly merger and use managerial hubris to improve results at maximum. c. welcome the acquisition and use knowledge transfer to impart sam hardware's management practices. d. do nothing; the two companies cannot combine without samm hardware's explicit consent.

Answers: 1

Business, 22.06.2019 22:30

Using the smith's bbq report, the cost of wine for next week will increase by 2% from the current week. if all other cost of sales stays constant, what will be the approximate total cost of sales for next week?

Answers: 2

You know the right answer?

Ron is 25 years old and is retiring at the age of 65. when he retires, he will need a monthly income...

Questions

Mathematics, 08.12.2020 01:10

Mathematics, 08.12.2020 01:10

Physics, 08.12.2020 01:10

Mathematics, 08.12.2020 01:10

Mathematics, 08.12.2020 01:10

English, 08.12.2020 01:10

Computers and Technology, 08.12.2020 01:10

History, 08.12.2020 01:10