Business, 14.12.2019 03:31 gisellekarime

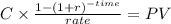

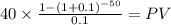

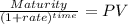

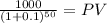

A$1,000 par value bond was issued five years ago at a 8 percent coupon rate. it currently has 25 years remaining to maturity. interest rates on similar debt obligations are now 10 percent. use appendix b and appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. compute the current price of the bond using an assumption of semiannual payments. (do not round intermediate calculations and round your answer to 2 decimal places.) b. if mr. robinson initially bought the bond at par value, what is his percentage capital gain or loss? (ignore any interest income received. do not round intermediate calculations and input the amount as a positive percent rounded to 2 decimal places.) c. now assume mrs. pinson buys the bond at its current market value and holds it to maturity, what will be her percentage capital gain or loss? (ignore any interest income received. do not round intermediate calculations and input the amount as a positive percent rounded to 2 decimal places.) d. why is the percentage gain larger than the percentage loss when the same dollar amounts are involved in parts b and c? the percentage gain is larger than the percentage loss because the investment is larger. the percentage gain is larger than the percentage loss because the investment is smaller.

Answers: 3

Another question on Business

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 22.06.2019 20:30

Casey communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. this action had no effect on the company's total assets or operating income. which of the following effects would occur as a result of this action? a. the company's current ratio increased.b. the company's times interest earned ratio decreased.c. the company's basic earning power ratio increased.d. the company's equity multiplier increased.e. the company's debt ratio increased.

Answers: 3

Business, 23.06.2019 12:30

Use the internet to research legal concerns that could result from increased use of technology in business. discuss some of these concerns.

Answers: 3

Business, 23.06.2019 16:30

Example1 lcnrv: ted company uses the lower of cost or nrv method in valuing its inventory items. the inventory at december 31, 2017, consists of products a, b and c, each having 1,000 units. relevant unit data for these products appear below: item a item b item c cost $ 80 $80 $80 estimated selling price 180 100 90 estimated selling cost 30 30 30 required: using the lower of cost or net realizable value rule, determine the proper value of inventory for balance sheet reporting purposes at december 31, 2017. prepare any necessary journal entry. apply the lower of cost or nrv method: • on an individual inventory basis; • on a group basis; • on a total inventory basis. solution worksheet: inventory (on an individual basis): inventory value item nrv cost lc- item a item b item c total inventory (on a group basis): inventory value item nrv cost lc- group 1 (item a and b) group 2 (item c) total inventory (on an aggregate inventory basis): inventory value item nrv cost lc- total inv

Answers: 3

You know the right answer?

A$1,000 par value bond was issued five years ago at a 8 percent coupon rate. it currently has 25 yea...

Questions

Health, 31.08.2019 08:00

History, 31.08.2019 08:00

English, 31.08.2019 08:00

English, 31.08.2019 08:00

Biology, 31.08.2019 08:00

Social Studies, 31.08.2019 08:00

History, 31.08.2019 08:00

History, 31.08.2019 08:00

History, 31.08.2019 08:00

Biology, 31.08.2019 08:00

Biology, 31.08.2019 08:00

Mathematics, 31.08.2019 08:00