Business, 14.12.2019 02:31 sadiesnider9

Bonita company produces golf discs which it normally sells to retailers for $7 each. the cost of manufacturing 23,600 golf discs is: materials $ 12,744 labor 36,344 variable overhead 24,308 fixed overhead 48,144 total $121,540 bonita also incurs 7% sales commission ($0.49) on each disc sold. mcgee corporation offers gruden $4.90 per disc for 5,100 discs. mcgee would sell the discs under its own brand name in foreign markets not yet served by bonita. if bonita accepts the offer, its fixed overhead will increase from $48,144 to $52,714 due to the purchase of a new imprinting machine. no sales commission will result from the special order.

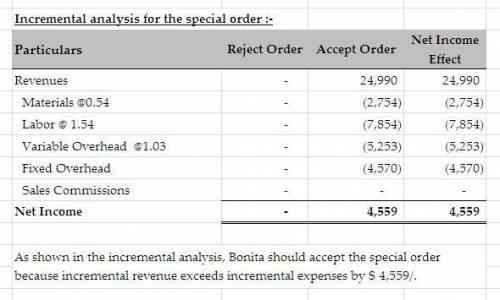

(a) prepare an incremental analysis for the special order. (enter negative amounts using either a negative sign preceding the number e. g. -45 or parentheses e. g. ( reject order accept order net income increase (decrease) revenues $ $ $ materials labor variable overhead fixed overhead sales commissions net income $ $ $

(b) should bonita accept the special order? bonita should the special order .

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

Use this image to answer the following question. when the economy is operating at point b, the us congress is most likely to follow

Answers: 3

Business, 22.06.2019 08:30

What is the key to success in integrating both lethal and nonlethal activities during planning? including stakeholders once a comprehensive operational approach has been determined knowing the commander's decision making processes and "touch points" including stakeholders from the very beginning of the design and planning process including the liaison officers (lnos) in all the decision points?

Answers: 1

Business, 22.06.2019 13:40

A.j. was a newly hired attorney for idle time gaming, inc. even though he reported directly to the president of the company, a.j. noticed that the president always had time to converse with the director of sales, calling on him to get a pulse on legal/regulatory issues that, as the company attorney, a.j. could have probably handled. a.j. also noted that the hr manager’s administrative assistant was the go-to person for a number of things that would make life easier at work. a.j. was recognizing the culture at idle time gaming.

Answers: 3

Business, 23.06.2019 17:30

Aiden is 19 years old, unmarried, and was a first-year full-time student working on a degree in accounting during 2018. he has never had a felony drug conviction. aiden did not provide more than half of his own support and can be claimed as a dependent by his mother. aiden’s income was $4,000 in wages working as a part-time cook at a fast food restaurant. aiden received form 1098-t indicating $5,000 for payments received for qualified tuition and related expenses in box 1. he received $8,500 in scholarships and grants, which was reported in box 5. aiden’s scholarship was used to pay for room and board, tuition, and books. the cost of his books was $845. aiden is a u.s. citizen with a valid social security number. 1. which of the following statements is true? a. the portion of the scholarship that was not used for qualified educational expenses must be included in aiden's income. b. the amount spent on books is not a qualified education expense. c. the taxable portion of the scholarship must be reported on aiden's mother’s return. d. none of aiden's scholarship is taxable.

Answers: 3

You know the right answer?

Bonita company produces golf discs which it normally sells to retailers for $7 each. the cost of man...

Questions

Spanish, 27.09.2019 19:30

Physics, 27.09.2019 19:30

English, 27.09.2019 19:30

English, 27.09.2019 19:30

Mathematics, 27.09.2019 19:30

Physics, 27.09.2019 19:30