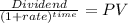

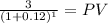

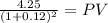

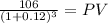

You are planning to purchase the stock of ted's sheds inc. and you expect it to pay a dividend of $3 in year 1, $4.25 in year 2 and $6.00 in year 3. you expect to sell the stock for $100 in year 3. if your required return for purchasing the stock is 12%, how much would you pay for the stock today?

Answers: 2

Another question on Business

Business, 22.06.2019 12:00

Agovernment receives a gift of cash and investments with a fair value of $200,000. the donor specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested. the $200,000 gift should be accounted for in which of the following funds? a) general fund b) private-purpose trust fund c) agency fund d) permanent fund

Answers: 1

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 17:30

The purchasing agent for a company that assembles and sells air-conditioning equipment in a latin american country noted that the cost of compressors has increased significantly each time they have been reordered. the company uses an eoq model to determine order size. what are the implications of this price escalation with respect to order size? what factors other than price must be taken into consideration?

Answers: 1

Business, 22.06.2019 17:30

An essential element of being receptive to messages is to have an open mind true or false

Answers: 2

You know the right answer?

You are planning to purchase the stock of ted's sheds inc. and you expect it to pay a dividend of $3...

Questions

Mathematics, 23.11.2020 19:40

Mathematics, 23.11.2020 19:40

Spanish, 23.11.2020 19:40

Biology, 23.11.2020 19:40

Mathematics, 23.11.2020 19:40

Mathematics, 23.11.2020 19:40

Mathematics, 23.11.2020 19:40

Social Studies, 23.11.2020 19:40

Mathematics, 23.11.2020 19:40