Business, 13.12.2019 21:31 chodister353

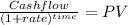

On jan 1, 2012, fin307 is considering the newly issued 10-year aaa corporate bond, which is due jan 1, 2022, with a coupon rate of 6% per year paid every 6 months. the bond is traded at par. suppose the market interest rate declines by 100 bps (i. e., 1%), what is the duration (before interest rate change) and the effect of the market interest decline on the bond price? hint: if your calculator does not have a build-in function for duration, go to excel and do the calculation manually by setting up 6 columns for t (=1, 2, 3…..20), df(discount factor or 1/pv factor), cf (cashflow), pv (present value of cf=cf*df), w(weight=pv/sum of pv or p0), and t*w. then sum up all t*w, then divide by 2 (because here coupon is paid semiannually).

Answers: 3

Another question on Business

Business, 21.06.2019 16:10

Baldwin has negotiated a new labor contract for the next round that will affect the cost for their product bold. labor costs will go from $7.91 to $8.41 per unit. in addition, their material costs have fallen from $13.66 to $12.66. assume all period costs as reported on baldwin's income statement remain the same. if baldwin were to pass on half the new costs of labor and half the savings in materials to customers by adjusting the price of their product, how many units of product bold would need to be sold next round to break even on the product?

Answers: 2

Business, 22.06.2019 12:20

In terms of precent, beer has more alcohol than whiskey true or false

Answers: 1

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

Business, 22.06.2019 19:40

Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. he now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. how many years will it take to exhaust his funds, i.e., run the account down to zero? a. 22.50 b. 23.63 c. 24.81 d. 26.05 e. 27.35

Answers: 2

You know the right answer?

On jan 1, 2012, fin307 is considering the newly issued 10-year aaa corporate bond, which is due jan...

Questions

Mathematics, 18.08.2021 01:20

Mathematics, 18.08.2021 01:20

Mathematics, 18.08.2021 01:20

Mathematics, 18.08.2021 01:20

Mathematics, 18.08.2021 01:20

English, 18.08.2021 01:20

Social Studies, 18.08.2021 01:20

Mathematics, 18.08.2021 01:20

English, 18.08.2021 01:20