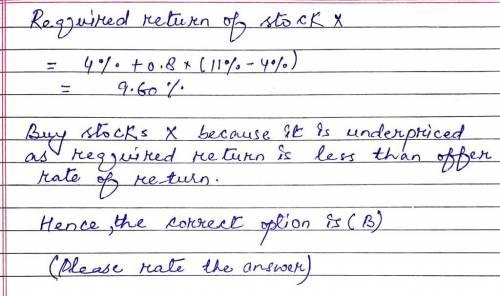

The risk-free rate is 4%. the expected market rate of return is 11%. if you expect stock x with a beta of .8 to offer a rate of return of 12 percent, then you should

a) buy stock x because it is overpriced

b) buy stock x because it is underpriced

c) sell short stock x because it is overpriced

d) sell short stock x because it is underpriced

e) stock x is correctly priced

Answers: 1

Another question on Business

Business, 21.06.2019 18:20

Which of the following housing decisions provides a person with both housing and an investment? a. selling a share in a cooperative. b. buying a single-family home. c. renting an apartment. d. subletting a condominium. 2b2t

Answers: 2

Business, 22.06.2019 07:30

Select the correct answer. sarah works in a coffee house where she is responsible for keying in customer orders. a customer orders snacks and coffee, but later, cancels th snacks, saying she wants only coffee. at the end of the day, sarah finds that there is a mismatch in the snack items ordered. which term suggest data has been violated? a. security b. integrity c. adding d. reliability e. reporting

Answers: 3

Business, 22.06.2019 17:00

Afinancing project has an initial cash inflow of $42,000 and cash flows of −$15,600, −$22,200, and −$18,000 for years 1 to 3, respectively. the required rate of return is 13 percent. what is the internal rate of return? should the project be accepted?

Answers: 1

Business, 22.06.2019 20:00

The master manufacturing company has just announced a tender offer for its own common stock. master is offering to buy up to 100% of the company's stock at $20 per share contingent on at least 64% of the outstanding shares being tendered. after the announcement of the offer, the stock closed on the nyse up 2.50 at $18.75. a customer has 100 shares of master stock in his cash account. the customer tells you that he wishes to "cash out" his position. you should recommend that the customer:

Answers: 2

You know the right answer?

The risk-free rate is 4%. the expected market rate of return is 11%. if you expect stock x with a be...

Questions

History, 13.04.2021 05:20

Mathematics, 13.04.2021 05:20

History, 13.04.2021 05:20

Engineering, 13.04.2021 05:20

History, 13.04.2021 05:20

Mathematics, 13.04.2021 05:20

Engineering, 13.04.2021 05:20

Mathematics, 13.04.2021 05:20

English, 13.04.2021 05:20

Mathematics, 13.04.2021 05:20

Biology, 13.04.2021 05:20