Business, 13.12.2019 01:31 kaneisha20

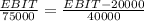

Katlin markets is debating between a levered and an unlevered capital structure. the all-equity capital structure would consist of 75,000 shares of stock. the debt and equity option would consist of 40,000 shares of stock plus $320,000 of debt with an interest rate of 6.25 percent. what is the break-even level of earnings before interest and taxes between these two options? ignore taxes. a. $46,333.33b. $44,140.71c. $42,208.15d. $49,666.67e. $42,857.14

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

Henry crouch's law office has traditionally ordered ink refills 55 units at a time. the firm estimates that carrying cost is 35% of the $11 unit cost and that annual demand is about 240 units per year. the assumptions of the basic eoq model are thought to apply. for what value of ordering cost would its action be optimal? a) for what value of ordering cost would its action be optimal?

Answers: 2

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

You know the right answer?

Katlin markets is debating between a levered and an unlevered capital structure. the all-equity capi...

Questions

SAT, 24.08.2019 15:20

Physics, 24.08.2019 15:20

Computers and Technology, 24.08.2019 15:20

Mathematics, 24.08.2019 15:20

Mathematics, 24.08.2019 15:20