Business, 12.12.2019 03:31 Natalierg05

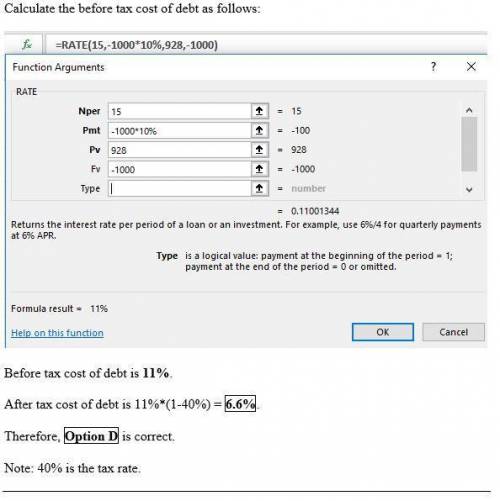

"easy rider inc. sold a 15 year $1,000 face value bond with a 10 percent coupon rate. interest is paid annually. after flotation costs, easy rider received $928 per bond. compute the after-tax cost of debt for these bonds if the firm's marginal tax rate is 40 percent.

a) 22%

b) 11%

c) l3%

d) 6.6%

e) 4.4%"

Answers: 1

Another question on Business

Business, 21.06.2019 20:20

The management at a pesticide manufacturing company has observed a decline in quality measures. the managers ask robin, the firm's hr manager, to investigate whether training might solve the problem. robin conducts needs assessment and recommends a training plan. which of the following conditions would most likely have been an observation during robin's person analysis?

Answers: 2

Business, 21.06.2019 21:00

Colah company purchased $1.8 million of jackson, inc. 8% bonds at par on july 1, 2018, with interest paid semi-annually. when the bonds were acquired colah decided to elect the fair value option for accounting for its investment. at december 31, 2018, the jackson bonds had a fair value of $2.08 million. colah sold the jackson bonds on july 1, 2019 for $1,620,000. the purchase of the jackson bonds on july 1. interest revenue for the last half of 2018. any year-end 2018 adjusting entries. interest revenue for the first half of 2019. any entry or entries necessary upon sale of the jackson bonds on july 1, 2019. required: 1. prepare colah's journal entries for above transaction.

Answers: 1

Business, 22.06.2019 21:00

Which of the following statements is correct? stockholders should generally be happier than bondholders to have managers invest in risky projects with high potential returns as opposed to safe projects with lower expected returns. potential conflicts between stockholders and bondholders are increased if a firm's bonds are convertible into its common stock. takeovers are most likely to be attempted if the target firm’s stock price is above its intrinsic value. one advantage of operating a business as a corporation is that stockholders can deduct their pro rata share of the taxes the firm pays, thereby eliminating the double taxation investors would face in a partnership.

Answers: 1

Business, 22.06.2019 23:30

Which statement best describes the two reactions? abcl, + h2 → 2hci2h + h = he + inreaction a involves a greater change, and reaction b involves a change in element identity.reaction b involves a greater change and a change in element identityreaction a involves a greater change and a change in element identity.reaction b involves a greater change, and reaction a involves a change in element identity.

Answers: 1

You know the right answer?

"easy rider inc. sold a 15 year $1,000 face value bond with a 10 percent coupon rate. interest is pa...

Questions

Mathematics, 30.09.2019 07:30

Engineering, 30.09.2019 07:30

Mathematics, 30.09.2019 07:30

Mathematics, 30.09.2019 07:30

Mathematics, 30.09.2019 07:30

Mathematics, 30.09.2019 07:30

Mathematics, 30.09.2019 07:30

Mathematics, 30.09.2019 07:30

Mathematics, 30.09.2019 07:30