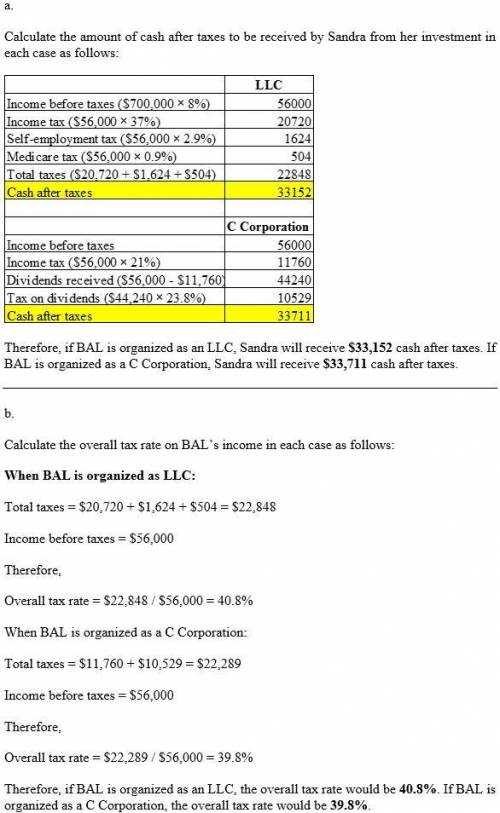

Sandra would like to organize bal as either an llc (taxed as a sole proprietorship) or a c corporation. in either form, the entity is expected to generate an 7 percent annual before-tax return on a $600,000 investment. sandra’s marginal income tax rate is 37 percent and her tax rate on dividends and capital gains is 23.8 percent (including the 3.8 percent net investment income tax). if sandra organizes bal as an llc, she will be required to pay an additional 2.9 percent for self-employment tax and an additional 0.9 percent for the additional medicare tax. bal’s income is not qualified business income (qbi) so sandra is not allowed to claim the qbi deduction. assume that bal will distribute all of its after-tax earnings every year as a dividend if it is formed as a c corporation. (round your intermediate computations to the nearest whole dollar amount.)

a. how much cash after taxes would sandra receive from her investment in the first year if bal is organized as either an llc or a c corporation?

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

An office manager is concerned with declining productivity. despite the fact that she regularly monitors her clerical staff four times each day—at 9: 00 am, 11: 00 am, 1: 00 pm, and again at 3: 00 pm—office productivity has declined 30 percent since she assumed the helm one year ago. would you recommend that the office manager invest more time monitoring the productivity of her clerical staff? explain.

Answers: 3

Business, 22.06.2019 08:40

Examine the following book-value balance sheet for university products inc. the preferred stock currently sells for $30 per share and pays a dividend of $3 a share. the common stock sells for $16 per share and has a beta of 0.9. there are 2 million common shares outstanding. the market risk premium is 9%, the risk-free rate is 5%, and the firm’s tax rate is 40%. book-value balance sheet (figures in $ millions) assets liabilities and net worth cash and short-term securities $ 2.0 bonds, coupon = 6%, paid annually (maturity = 10 years, current yield to maturity = 8%) $ 5.0 accounts receivable 3.0 preferred stock (par value $15 per share) 3.0 inventories 7.0 common stock (par value $0.20) 0.4 plant and equipment 21.0 additional paid-in stockholders’ equity 13.6 retained earnings 11.0 total $ 33.0 total $ 33.0 a. what is the market debt-to-value ratio of the firm? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. what is university’s wacc? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 3

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 20:10

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

You know the right answer?

Sandra would like to organize bal as either an llc (taxed as a sole proprietorship) or a c corporati...

Questions

Mathematics, 09.10.2019 02:00

Mathematics, 09.10.2019 02:00

English, 09.10.2019 02:00

History, 09.10.2019 02:00

History, 09.10.2019 02:00

Health, 09.10.2019 02:00

World Languages, 09.10.2019 02:00

Mathematics, 09.10.2019 02:00

English, 09.10.2019 02:00

Mathematics, 09.10.2019 02:00

Social Studies, 09.10.2019 02:00