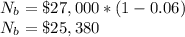

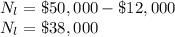

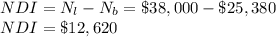

Keating co. is considering disposing of equipment with a cost of $61,000 and accumulated depreciation of $42,700. keating co. can sell the equipment through a broker for $27,000, less a 6% broker commission. alternatively, gunner co. has offered to lease the equipment for five years for a total of $50,000. keating will incur repair, insurance, and property tax expenses estimated at $12,000 over the five-year period. at lease-end, the equipment is expected to have no residual value.

1. the net differential income from the lease alternative is

Answers: 3

Another question on Business

Business, 22.06.2019 16:50

The cost of labor is significantly lower in many countries than in the united states. if you move manufacturing to a facility to a country labeled as part of the axis of evil and a threat to world peace you will increase the net income of your client by $10 million per the facility is located in a country which limits personal freedom and engages in state sponsored terrorism. imagine you are a marketing consultant. (a) what would you tell the executives to do? (b) what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 1

Business, 22.06.2019 19:10

You have just been hired as a brand manager at kelsey-white, an american multinational consumer goods company. recently the firm invested in the development of k-w vision, a series of systems and processes that allow the use of up-to-date data and advanced analytics to drive informed decision making about k-w brands. it is 2018. the system is populated with 3 years of historical data. as brand manager for k-w’s blue laundry detergent, you are tasked to lead the brand's turnaround. use the vision platform to to develop your strategy and grow blue’s market share over the next 4 years.

Answers: 2

Business, 23.06.2019 05:10

To use google as main search engine, which internet browser can i use

Answers: 2

Business, 23.06.2019 15:30

A. economic resources to be used or turned into cash within one year. b. reports assets, liabilities, and stockholders' equity. c. decrease assets; increase liabilities and stockholders' equity. d. increase assets; decrease liabilities and stockholders' equity. e. an exchange or event that has a direct and measurable financial effect. f. accounts for a business separate from its owners. g. the principle that assets should be recorded at their original cost to the company. h. a standardized format used to accumulate data about each item reported on financial statements. i. the basic accounting equation. j. the two equalities in accounting that aid in providing accuracy. k. the account credited when money is borrowed from a bank using a promissory note. l. cumulative earnings of a company that have not yet been distributed to the owners. m. every transaction has at least two effects. n. amounts presently owed by the business. transaction, separate entity assumption, balance sheet, liabilities, assets, current assets, notes payable, duality of effects, retained earnings, debit.

Answers: 3

You know the right answer?

Keating co. is considering disposing of equipment with a cost of $61,000 and accumulated depreciatio...

Questions

Computers and Technology, 01.02.2021 19:00

Advanced Placement (AP), 01.02.2021 19:00

Social Studies, 01.02.2021 19:00

Arts, 01.02.2021 19:00

Mathematics, 01.02.2021 19:00

French, 01.02.2021 19:00

History, 01.02.2021 19:00

Mathematics, 01.02.2021 19:00

Mathematics, 01.02.2021 19:00