Business, 09.12.2019 21:31 kayyjayy3106

Suppose you are the purchasing manager for a large chain of restaurants in the united states, and you need to make your semiannual purchase of tea. you pay $1,500,000 for a shipment of tea from an indian tea producer.

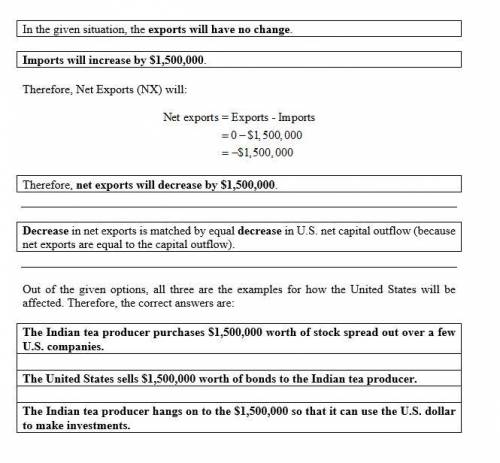

(1) what is the impact of this purchase on us imports and capital flows?

(2) what is the impact of this transaction on us net exports?

how would these same flows be impacted by these transactions?

a. the indian tea producer purchases $1,500,000 worth of stock spread out over a few u. s. companies.

b. the united states sells $1,500,000 worth of bonds to the indian tea producer.

c. the indian tea producer hangs on to the $1,500,000 so that it can use the u. s. dollars to make investments.

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

Tina is applying for the position of a daycare assistant at a local childcare center. which document should tina send with a résumé to her potential employer? a. educational certificate b. work experience certificate c. cover letter d. follow-up letter

Answers: 1

Business, 22.06.2019 07:50

In december of 2004, the company you own entered into a 20-year contract with a grain supplier for daily deliveries of grain to its hot dog bun manufacturing facility. the contract called for "10,000 pounds of grain" to be delivered to the facility at the price of $100,000 per day. until february 2017, the supplier provided processed grain which could easily be used in your manufacturing process. however, no longer wanting to absorb the cost of having the grain processed, the supplier began delivering whole grain. the supplier is arguing that the contract does not specify the type of grain that would be supplied and that it has not breached the contract. your company is arguing that the supplier has an onsite processing plant and processed grain was implicit to the terms of the contract. over the remaining term of the contract, reshipping and having the grain processed would cost your company approximately $10,000,000, opposed to a cost of around $1,000,000 to the supplier. after speaking with in-house counsel, it was estimated that litigation would cost the company several million dollars and last for years. weighing the costs of litigation, along with possible ambiguity in the contract, what are three options you could take to resolve the dispute? which would be the best option for your business and why?

Answers: 2

Business, 22.06.2019 08:50

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 18:10

Find the zeros of the polynomial 5 x square + 12 x + 7 by factorization method and verify the relation between zeros and coefficient of the polynomials

Answers: 1

You know the right answer?

Suppose you are the purchasing manager for a large chain of restaurants in the united states, and yo...

Questions

German, 06.04.2021 14:00

English, 06.04.2021 14:00

Mathematics, 06.04.2021 14:00

History, 06.04.2021 14:00

Computers and Technology, 06.04.2021 14:00

German, 06.04.2021 14:00

Biology, 06.04.2021 14:00

Social Studies, 06.04.2021 14:00

Mathematics, 06.04.2021 14:00

English, 06.04.2021 14:00

History, 06.04.2021 14:00

Computers and Technology, 06.04.2021 14:00