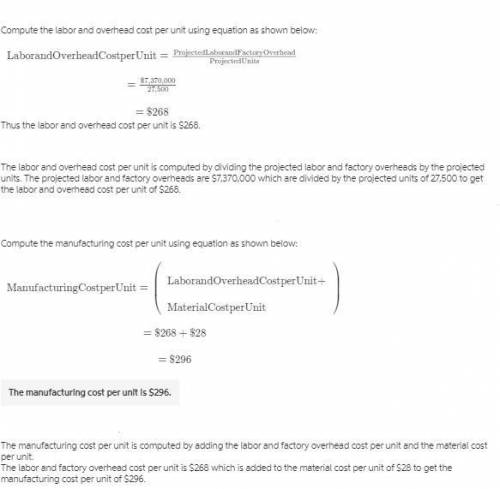

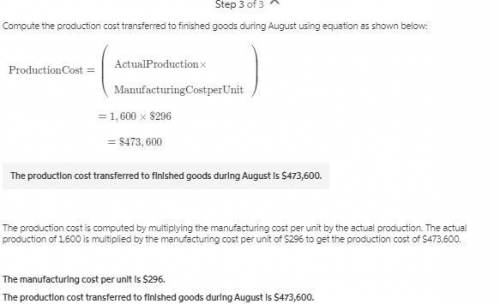

Sifton electronics corporation manufactures and assembles electronic motor drives for video cameras. the company assembles the motor drives for several accounts. the process consists of a lean cell for each customer. the following information relates only to one customer's lean cell for the coming year. projected labor and overhead, $7,370,000; materials costs, $28 per unit. planned production included 4,000 hours to produce 27,500 motor drives. actual production for august was 1,600 units, and motor drives shipped amounted to 1,380 units. a. from the foregoing information, determine the production costs transferred to finished goods during augustb. from the foregoing information, determine the manufacturing cost per unit

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

Kyle and alyssa paid $1,000 and $4,000 in qualifying expenses for their two daughters jane and jill, respectively, to attend the university of california. jane is a sophomore and jill is a freshman. kyle and alyssa's agi is $135,000 and they file a joint return. what is their allowable american opportunity tax credit after the credit phase-out based on agi is taken into account?

Answers: 1

Business, 22.06.2019 13:10

Laval produces lamps and home lighting fixtures. its most popular product is a brushed aluminum desk lamp. this lamp is made from components shaped in the fabricating department and assembled in the assembly department. information related to the 22,000 desk lamps produced annually follows.direct materials $280,000direct labor fabricating department (8,000 dlh × $24 per dlh) $192,000assembly department (16,600 dlh × $26 per dlh) $431,600machine hours fabricating department $15,200mhassembly department $20,850mhexpected overhead cost and related data for the two production departments follow.fabricating assemblydirect labor hours 150,000dlh 295,000dlhmachine hours 161,000mh 128,000mhoverhead cost $400,000 430,000required1. determine the plantwide overhead rate for laval using direct labor hours as a base.2. determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.3. compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.4. use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

Answers: 3

Business, 22.06.2019 15:40

The cost of direct labor used in production is recorded as a? a. credit to work-in-process inventory account. b. credit to wages payable. c. credit to manufacturing overhead account. d. credit to wages expense.

Answers: 2

Business, 23.06.2019 01:00

"consists of larger societal forces that affect how a company engages and serves its customers."

Answers: 1

You know the right answer?

Sifton electronics corporation manufactures and assembles electronic motor drives for video cameras....

Questions

Mathematics, 11.02.2020 20:00

French, 11.02.2020 20:00

Social Studies, 11.02.2020 20:00

Mathematics, 11.02.2020 20:00

Biology, 11.02.2020 20:01

History, 11.02.2020 20:01

Mathematics, 11.02.2020 20:01

Mathematics, 11.02.2020 20:01

Biology, 11.02.2020 20:01