Business, 30.11.2019 05:31 JohnJamesPaksitani

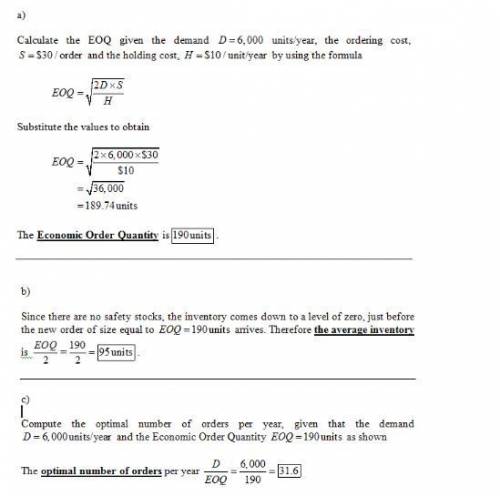

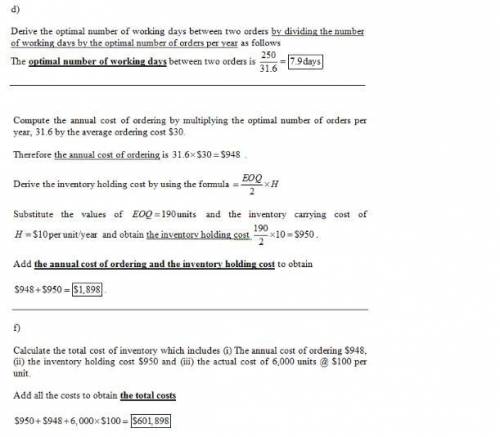

Thomas kratzer is the purchasing manager for the headquarters of a large insurance company chain with a central inventory operation. thomas’s fastest moving inventory item has a demand of 6000 units per year. the cost of each unit is $100.00, and the inventory carrying cost is $10.00 per unit per year. the average ordering cost is $30.00 per order. it takes about 5 days for an order to arrive, and demand for 1 week is 120 units (this is a corporate operation, there are 250 working days per year). a. what is the eoq? b. what is the average inventory if the eoq is used? c. what is the optimal number of orders per year? d. what is the optimal number of days in between any two orders? e. what is the annual cost of ordering and holding and holding inventory? f. what is the total annual inventory cost, including cost of the 6,000 units?

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

Which alternative accounting method allows farmers to record expenses and incomes in the year in which they sell their yield? gaap allows for the method, which permits farmers to subtract the expenses of producing the crop in the year in which they sell the yield and earn the revenue.

Answers: 3

Business, 22.06.2019 05:30

Eliza works for a consumer agency educating young people about advertisements. instead of teaching students to carefully read advertisement claims, she encourages them to develop a strong sense of self and to keep their life goals and dreams separate from commercial products. why might eliza's advice make sense?

Answers: 2

Business, 22.06.2019 12:30

Consider a treasury bill with a rate of return of 5% and the following risky securities: security a: e(r) = .15; variance = .0400 security b: e(r) = .10; variance = .0225 security c: e(r) = .12; variance = .1000 security d: e(r) = .13; variance = .0625 the investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. the security the investor should choose as part of her complete portfolio to achieve the best cal would be a. security a b. security b c. security c d. security d

Answers: 3

Business, 22.06.2019 13:00

Creation landscaping has 1,000 bonds outstanding that are selling for $1,280 each. the company also has 2,000 shares of preferred stock outstanding, currently priced at $27.20 a share. the common stock is priced at $37.00 a share and there are 28,000 shares outstanding. what is the weight of the debt as it relates to the firm's weighted average cost of capital?

Answers: 1

You know the right answer?

Thomas kratzer is the purchasing manager for the headquarters of a large insurance company chain wit...

Questions

Mathematics, 13.06.2020 03:57

Social Studies, 13.06.2020 03:57

Mathematics, 13.06.2020 03:57

Business, 13.06.2020 03:57

English, 13.06.2020 03:57

Mathematics, 13.06.2020 03:57

English, 13.06.2020 03:57

Mathematics, 13.06.2020 03:57

Mathematics, 13.06.2020 03:57

Chemistry, 13.06.2020 03:57