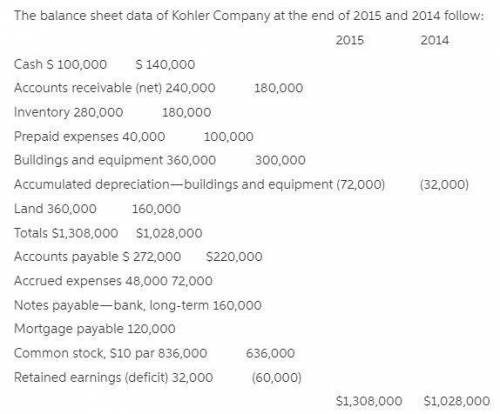

Land was acquired for $200,000 in exchange for common stock, par $200,000, during the year; all equipment purchased was for cash. equipment costing $20,000 was sold for $8,000; book value of the equipment was$16,000 and the loss was reported as an ordinary item in net income. cash dividends of $40,000 were charged to retained earnings and paid during the year; the transfer of net income to retained earnings was the only other entry in the retained earnings account. in the statement of cash flows for the year ended december 31,2015, for naley company: 1. the net cash provided by operating activities wasa) $104,000.b) $132,000.c) $112,000.d) $96,000.

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Iam trying to get more members on my blog. how do i do that?

Answers: 2

Business, 22.06.2019 05:20

Social computing forces companies to deal with customers as opposed to

Answers: 2

Business, 22.06.2019 10:10

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

Business, 22.06.2019 13:30

Tom has brought $150,000 from his pension to a new job where his employer will match 401(k) contributions dollar for dollar. each year he contributes $3,000. after seven years, how much money would tom have in his 401(k)?

Answers: 3

You know the right answer?

Land was acquired for $200,000 in exchange for common stock, par $200,000, during the year; all equ...

Questions

History, 25.09.2020 01:01

Mathematics, 25.09.2020 01:01

History, 25.09.2020 01:01

History, 25.09.2020 01:01

History, 25.09.2020 01:01

Mathematics, 25.09.2020 01:01

Mathematics, 25.09.2020 01:01

Mathematics, 25.09.2020 01:01

Biology, 25.09.2020 01:01

Mathematics, 25.09.2020 01:01

Mathematics, 25.09.2020 01:01