Business, 30.11.2019 02:31 halobry2003

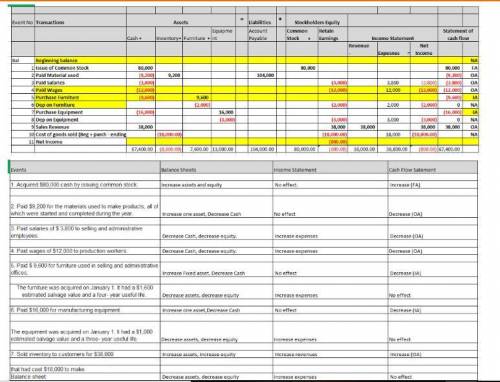

Gunn manufacturing company experienced the following accounting events during its first year of operation. with the exception of the adjusting entries for depreciation, assume that all transactions are cash transactions.

1. acquired $80,000 cash by issuing common stock.

2. paid $9,200 for the materials used to make its products, all of which were started and completed during the year.

3. paid salaries of $3,800 to selling and administrative employees.

4. paid wages of $12,000 to production workers.

5. paid $9,600 for furniture used in selling and administrative offices. the furniture was acquired on january 1. it had a $1,600 estimated salvage value and a four-year useful life.

6. paid $16,000 for manufacturing equipment. the equipment was acquired on january 1. it had a $1,000 estimated salvage value and a five-year useful life.

7. sold inventory to customers for $38,000 that had cost $18,000 to make.

required:

show how these events would affect the balance sheet, income statement, and statement of cash flows by recording them in a horizontal financial statements model as indicated here. also, in the cash flow column, indicate whether the cash flow is for operating activities (oa), investing activities (ia), or financing activities (fa). use na to indicate that an element is not affected by the event. the first event is recorded as an example. (enter any decreases to account balances and cash outflows with a minus sign.)

Answers: 3

Another question on Business

Business, 22.06.2019 09:40

Henry crouch's law office has traditionally ordered ink refills 55 units at a time. the firm estimates that carrying cost is 35% of the $11 unit cost and that annual demand is about 240 units per year. the assumptions of the basic eoq model are thought to apply. for what value of ordering cost would its action be optimal? a) for what value of ordering cost would its action be optimal?

Answers: 2

Business, 22.06.2019 17:00

Cadbury has a chocolate factory in dunedin, new zealand. for easter, it makes two kinds of “easter eggs”: milk chocolate and dark chocolate. it cycles between producing milk and dark chocolate eggs. the table below provides data on these two products. demand (lbs per hour) milk: 500 dark: 200 switchover time (minutes) milk: 60 dark: 30 production rate per hour milk: 800 dark: 800 for example, it takes 30 minutes to switch production from milk to dark chocolate. demand for milk chocolate is higher (500lbs per hour versus 200 lbs per hour), but the line produces them at the same rate (when operating): 800 lbs per hour. a : suppose cadbury produces 2,334lbs milk chocolate and 1,652 lbs of dark chocolate in each cycle. what would be the maximum inventory (lbs) of milk chocolate? b : how many lbs of milk and dark chocolate should be produced with each cycle so as to satisfy demand while minimizing inventory?

Answers: 2

Business, 22.06.2019 22:20

Which of the following events could increase the demand for labor? a. an increase in the marginal productivity of workers b. a decrease in the amount of capital available for workers to use c. a decrease in the wage paid to workers d. a decrease in output price

Answers: 1

Business, 22.06.2019 23:50

Melissa buys an iphone for $240 and gets consumer surplus of $160. a. what is her willingness to pay? b. if she had bought the iphone on sale for $180, what would her consumer surplus have been?

Answers: 3

You know the right answer?

Gunn manufacturing company experienced the following accounting events during its first year of oper...

Questions

English, 25.03.2021 09:10

Social Studies, 25.03.2021 09:10

History, 25.03.2021 09:10

Mathematics, 25.03.2021 09:10

Mathematics, 25.03.2021 09:10

Physics, 25.03.2021 09:10

English, 25.03.2021 09:10

Biology, 25.03.2021 09:10

Spanish, 25.03.2021 09:10

History, 25.03.2021 09:10

Chemistry, 25.03.2021 09:10