Business, 28.11.2019 07:31 nickmoose04

On december 31, 2020, culver inc. rendered services to beghun corporation at an agreed price of $124,077, accepting $48,000 down and agreeing to accept the balance in four equal installments of $24,000 receivable each december 31. an assumed interest rate of 10% is imputed.

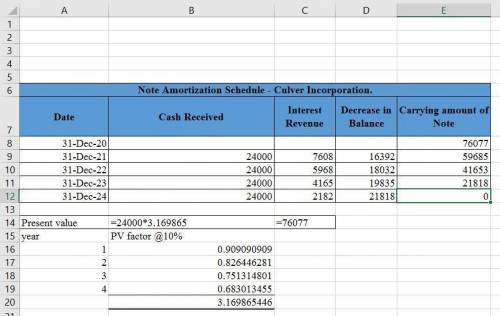

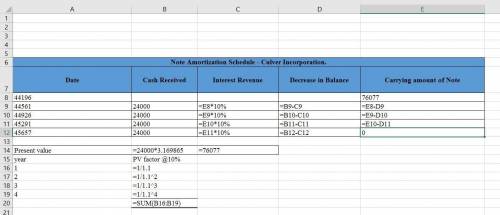

prepare an amortization schedule. assume that the effective-interest method is used for amortization purposes. (round answers to 0 decimal places, e. g. 5,275.)

december 31, 2020

schedule of note discount amortization

date

cash

received

interest

revenue

carrying

amount of note

12/31/20 $ $ $

12/31/21

12/31/22

12/31/23

12/31/24

etextbook and media

list of accounts

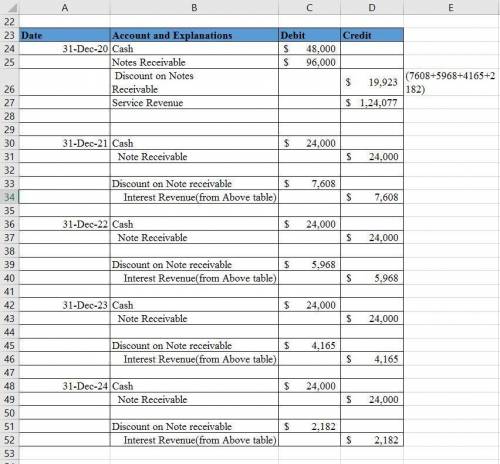

prepare the entries that would be recorded by culver inc. for the sale on december 31, 2020. (round answers to 0 decimal places, e. g. 5,275. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

account titles and explanation

debit

credit

etextbook and media

list of accounts

prepare the entries that would be recorded by culver inc. for the (a) receipts and (b) interest on december 31, 2021. (round answers to 0 decimal places, e. g. 5,275. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

no.

account titles and explanation

debit

credit

(a)

(b)

etextbook and media

list of accounts

prepare the entries that would be recorded by culver inc. for the (a) receipts and (b) interest on december 31, 2022. (round answers to 0 decimal places, e. g. 5,275. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

no.

account titles and explanation

debit

credit

(a)

(b)

etextbook and media

list of accounts

prepare the entries that would be recorded by culver inc. for the (a) receipts and (b) interest on december 31, 2023. (round answers to 0 decimal places, e. g. 5,275. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

no.

account titles and explanation

debit

credit

(a)

(b)

etextbook and media

list of accounts

prepare the entries that would be recorded by culver inc. for the (a) receipts and (b) interest on december 31, 2024. (round answers to 0 decimal places, e. g. 5,275. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

no.

account titles and explanation

debit

credit

(a)

(b)

Answers: 3

Another question on Business

Business, 21.06.2019 19:30

What preforms the best over the long term? a) bonds b) mutual funds c) stocks d) certificate of deposit

Answers: 2

Business, 22.06.2019 01:30

Monica needs to assess the slide sequence and make quick changes to it. which view should she use in her presentation program? a. outline b. slide show c. slide sorter d. notes page e. handout

Answers: 1

Business, 22.06.2019 11:40

Fanning company is considering the addition of a new product to its cosmetics line. the company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. relevant information and budgeted annual income statements for each of the products follow. skin cream bath oil color gel budgeted sales in units (a) 110,000 190,000 70,000 expected sales price (b) $8 $4 $11 variable costs per unit (c) $2 $2 $7 income statements sales revenue (a × b) $880,000 $760,000 $770,000 variable costs (a × c) (220,000) (380,000) (490,000) contribution margin 660,000 380,000 280,000 fixed costs (432,000) (240,000) (76,000) net income $228,000 $140,000 $204,000 required: (a) determine the margin of safety as a percentage for each product. (b) prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. (c) for each product, determine the percentage change in net income that results from the 20 percent increase in sales. (d) assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? (e) assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Answers: 1

Business, 22.06.2019 15:20

On january 2, 2018, bering co. disposes of a machine costing $34,100 with accumulated depreciation of $18,369. prepare the entries to record the disposal under each of the following separate assumptions. exercise 8-24a part 2 2. the machine is traded in for a newer machine having a $50,600 cash price. a $16,238 trade-in allowance is received, and the balance is paid in cash. assume the asset exchange has commercial substance.

Answers: 2

You know the right answer?

On december 31, 2020, culver inc. rendered services to beghun corporation at an agreed price of $124...

Questions

English, 02.10.2021 01:00

History, 02.10.2021 01:00

Advanced Placement (AP), 02.10.2021 01:00

Mathematics, 02.10.2021 01:00

Physics, 02.10.2021 01:00

Spanish, 02.10.2021 01:00

Chemistry, 02.10.2021 01:00

History, 02.10.2021 01:00