The chapter notes that the rise in the u. s. trade deficit during the 1980s was due largely to the rise in the u. s. budget deficit. on the other hand, some in the popular press have claimed that the increased trade deficit resulted from a decline in the quality of u. s. products relative to foreign products.

assume that u. s. products did decline in relative quality during the 1980s.

this caused net exports at any given exchange rate to increase/decrease?

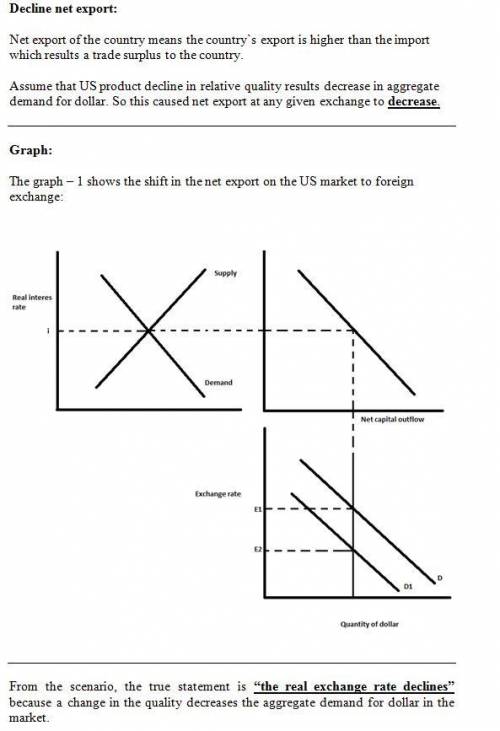

indicate the effect of this shift in net exports on the u. s. market for foreign exchange.

(draw a graph)

according to this model, which of the following statements are true as a result of the quality change? check all that apply.

there is no change in the real interest rate.

net capital outflow is unchanged.

there is no change in the trade balance.

the real exchange rate declines.

true or false: the claim that some people made in the popular press is consistent with the model in this chapter.

true or false: a decline in the quality of u. s. products may increase our standard of living because of a decline in the real exchange rate.

an economist discussing trade policy in the new republic wrote: "one of the benefits of the united states removing its trade restrictions [is] the gain to u. s. industries that produce goods for export. export industries would find it easier to sell their goods abroad—even if other countries didn’t follow our example and reduce their trade barriers."

a reduction in restrictions of imports would raise/reduce net exports at any given real exchange rate, thus shifting the demand curve for dollars to the left/right. this causes the real exchange rate to increase/decrease, increasing/decreasing net exports. however, net capital outflow is unchanged, so the equilibrium level of net exports increases/decreases/remains unchanged. this means that both imports and exports fall/only exports rise/only imports rise/both imports and exprts rise.

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Lo.2, 3, 9 lori, who is single, purchased 5-years class property for $200,00 and 7-years class property for $420,000 on may 20, 2018. lori experts the taxable income derived form the business (without regard to the amount expensed under ⧠179) to be about $550,000. lori has determined that she should elect immediate ⧠179 expensing in the amount of $520,000, but she doesn’t know which asset she should completely expense under ⧠179. she does not claim any available additional first-year depreciation. a. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 5-year class asset. b. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 7-year class asset. c. what is your advice for lori? d. assume that lori is in the 24% marginal tax bracket and that she uses ⧠179 on the 7-year asset. determine the present value of the tax savings from the depreciation deductions for both assets. see appendix g for present value factors, and assume a 6% discount rate. e. assume the same facts as in part (d), except that lori decides not to use ⧠179 on either asset. determine the present value of the tax savings under this choice. in addition, determine which option lori should choose. f. present your solution to parts (d) and (e) of the problem in a spreadsheet using appropriate microsoft excel formulas. e-mail your spreadsheet to your instructor with a two-paragraph summary of your findings.

Answers: 1

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 18:30

Health insurance protects you if you experience any of the following except: a: if you have to be hospitalized b: if you damage someone's property c: if you need to visit a clinic d: if you can't work because of illness

Answers: 2

Business, 22.06.2019 19:10

After the price floor is instituted, the chairman of productions office buys up any barrels of gosum berries that the producers are not able to sell. with the price floor, the producers sell 300 barrels per month to consumers, but the producers, at this high price floor, produce 700 barrels per month. how much producer surplus is created with the price floor? show your calculations.

Answers: 2

You know the right answer?

The chapter notes that the rise in the u. s. trade deficit during the 1980s was due largely to the r...

Questions

Mathematics, 25.06.2020 02:01

History, 25.06.2020 02:01

Mathematics, 25.06.2020 02:01

Physics, 25.06.2020 02:01

History, 25.06.2020 02:01

Mathematics, 25.06.2020 02:01

Mathematics, 25.06.2020 02:01

Mathematics, 25.06.2020 02:01

Mathematics, 25.06.2020 02:01

Mathematics, 25.06.2020 02:01

History, 25.06.2020 02:01