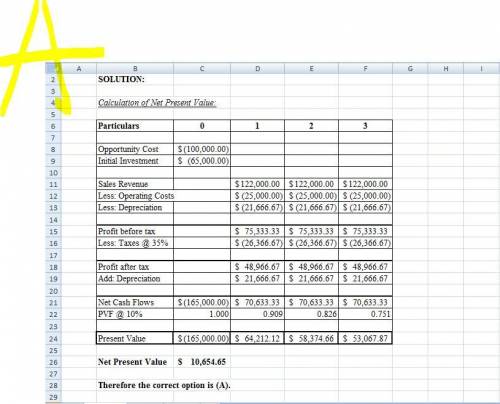

Sub-prime loan company is thinking of opening a new office, and the key data are shown below. the company owns the building that would be used, and it could sell it for $100,000 after taxes if it decides not to open the new office. the equipment for the project would be depreciated by the straight-line method over the project's 3-year life, after which it would be worth nothing and thus it would have a zero salvage value. no change in net operating working capital would be required, and revenues and other operating costs would be constant over the project's 3-year life. what is the project's npv? (hint: cash flows are constant in years 1-3.)wacc 10.0%opportunity cost $100,000net equipment cost (depreciable basis) $65,000straight-line depreciation rate for equipment 33.333%annual sales revenues $123,000annual operating costs (excl. depreciation) $25,000tax rate 35%a. $10,521b. $11,075c. $11,658d. $12,271e. $12,885

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Anewspaper boy is trying to perfect his business in order to maximize the money he can save for a new car. daily paper sales are normally distributed, with a mean of 100 and standard deviation of 10. he sells papers for $0.50 and pays $0.30 for them. unsold papers are trashed with no salvage value. how many papers should he order each day and what % of the time will he experience a stockout? are there any drawbacks to the order size proposed and how could the boy address such issues?

Answers: 3

Business, 22.06.2019 11:00

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 21:00

Reagan corporation is a wholesale distributor of truck replacement parts. initial amounts taken from reagan's records are as follows:

Answers: 1

You know the right answer?

Sub-prime loan company is thinking of opening a new office, and the key data are shown below. the co...

Questions

Computers and Technology, 19.02.2020 17:37

Mathematics, 19.02.2020 17:37

Computers and Technology, 19.02.2020 17:37

Computers and Technology, 19.02.2020 17:37

Computers and Technology, 19.02.2020 17:38