Business, 28.11.2019 01:31 dtilton2003

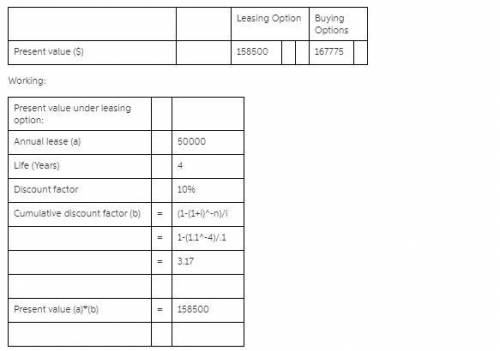

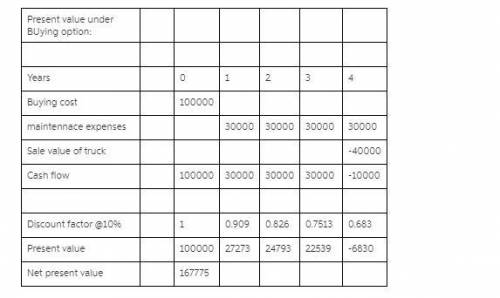

Afirm can lease a truck for 4 years at a cost of $50,000 annually. it can instead buy a truck at a cost of $100,000, with annual maintenance expenses of $30,000. the truck will be sold at the end of 4 years for $40,000. a. calculate present value if the discount rate is 10%?

Answers: 3

Another question on Business

Business, 21.06.2019 14:00

Will you use single-entry bookkeeping or double-entry bookkeeping? explain why.

Answers: 1

Business, 22.06.2019 16:50

Arestaurant that creates a new type of sandwich is using (blank) as a method of competition.

Answers: 1

Business, 22.06.2019 18:00

On september 1, 2016, steve loaned brett $2,000 at 12% interest compounded annually. steve is not in the business of lending money. the note stated that principal and interest would be due on august 31, 2018. in 2018, steve received $2,508.80 ($2,000 principal and $508.80 interest). steve uses the cash method of accounting. what amount must steve include in income on his income tax return?

Answers: 1

Business, 22.06.2019 20:00

Richard is one of the leading college basketball players in the state of florida. he also maintains a good academic record. looking at his talent and potential, furman university offers to bear the expenses for his college education.

Answers: 3

You know the right answer?

Afirm can lease a truck for 4 years at a cost of $50,000 annually. it can instead buy a truck at a c...

Questions

Mathematics, 23.04.2021 22:20

Mathematics, 23.04.2021 22:20

Mathematics, 23.04.2021 22:20

Mathematics, 23.04.2021 22:20

Mathematics, 23.04.2021 22:20

Mathematics, 23.04.2021 22:20

Mathematics, 23.04.2021 22:20

Mathematics, 23.04.2021 22:20