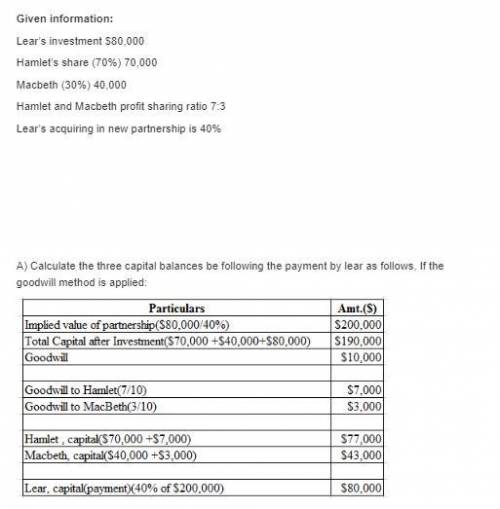

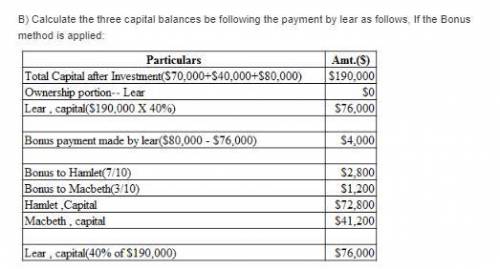

17. lear is to become a partner in the ws partnership by paying $80,000 in cash to the business. at present, the capital balance for hamlet is $70,000 and for macbeth is $40,000. hamlet and macbeth share profits on a 7: 3 basis. lear is acquiring 40 percent of the new partnership. a. if the goodwill method is applied, what will the three capital balances be following the payment by lear? b. if the bonus method is applied, what will the three capital balances be following the payment by lear?

Answers: 2

Another question on Business

Business, 21.06.2019 15:30

Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a passive investment in a limited partnership, and a $26,000 passive loss from a real estate rental activity in which she actively participates. if her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible

Answers: 1

Business, 22.06.2019 10:30

Which analyst position analyzes information using mathematical models to business managers make decisions? -budget analyst -management analyst -credit analyst -operations research analyst

Answers: 1

Business, 22.06.2019 17:30

If springfield is operating at full employment who is working a. everyone b. about 96% of the workforce c. the entire work force d. the robots

Answers: 1

You know the right answer?

17. lear is to become a partner in the ws partnership by paying $80,000 in cash to the business. at...

Questions

Chemistry, 03.08.2019 02:30

Computers and Technology, 03.08.2019 02:30

Physics, 03.08.2019 02:30

Mathematics, 03.08.2019 02:30

Mathematics, 03.08.2019 02:30

Mathematics, 03.08.2019 02:30

Spanish, 03.08.2019 02:30

Mathematics, 03.08.2019 02:30

Health, 03.08.2019 02:30

Chemistry, 03.08.2019 02:30

History, 03.08.2019 02:30

Mathematics, 03.08.2019 02:30