Business, 27.11.2019 23:31 17jhester1

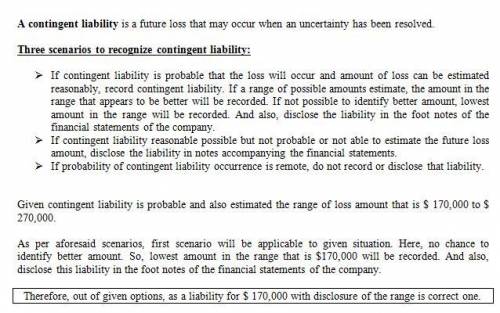

Reeves co. filed suit against higgins, inc., seeking damages for copyright violations. higgins' legal counsel believes it is probable that higgins will settle the lawsuit for an estimated amount in the range of $170,000 to $270,000, with all amounts in the range considered equally likely. how should higgins report this litigation?

as a liability for $170,000 with disclosure of the range.

as a disclosure only. no liability is reported.

as a liability for $270,000 with disclosure of the range.

as a liability for $220,000 with disclosure of the range.

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

On september 12, ryan company sold merchandise in the amount of $5,800 to johnson company, with credit terms of 2/10, n/30. the cost of the items sold is $4,000. ryan uses the periodic inventory system and the net method of accounting for sales. on september 14, johnson returns some of the non-defective merchandise, which is restored to inventory. the selling price of the returned merchandise is $500 and the cost of the merchandise returned is $350. the entry or entries that ryan must make on september 14 is (are): multiple choice sales returns and allowances 490 accounts receivable 490 merchandise inventory 350 cost of goods sold 350 sales returns and allowances 490 accounts receivable 490 sales returns and allowances 500 accounts receivable 500 sales returns and allowances 490 accounts receivable 490 merchandise inventory 343 cost of goods sold 343 sales returns and allowances 350 accounts receivable 350

Answers: 1

Business, 22.06.2019 09:40

Boone brothers remodels homes and replaces windows. ace builders constructs new homes. if boone brothers considers expanding into new home construction, it should evaluate the expansion project using which one of the following as the required return for the project?

Answers: 1

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 15:20

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

You know the right answer?

Reeves co. filed suit against higgins, inc., seeking damages for copyright violations. higgins' lega...

Questions

Physics, 11.01.2021 14:00

History, 11.01.2021 14:00

Mathematics, 11.01.2021 14:00

Mathematics, 11.01.2021 14:00

Mathematics, 11.01.2021 14:00

Mathematics, 11.01.2021 14:00

Mathematics, 11.01.2021 14:00

World Languages, 11.01.2021 14:00

Mathematics, 11.01.2021 14:00

History, 11.01.2021 14:00

English, 11.01.2021 14:00

Physics, 11.01.2021 14:00

Mathematics, 11.01.2021 14:00

English, 11.01.2021 14:00