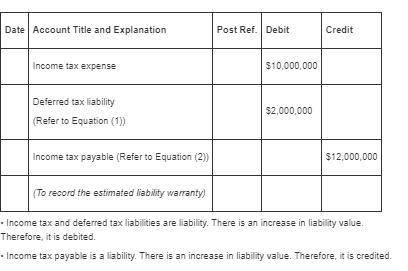

Bronson industries reported a deferred tax liability of $8 million for the year ended december 31, 2017, related to a temporary difference of $20 million. the tax rate was 40%. the temporary difference is expected to reverse in 2019 at which time the deferred tax liability will become payable. there are no other temporary differences in 2017–2019. assume a new tax law is enacted in 2018 that causes the tax rate to change from 40% to 30% beginning in 2019. (the rate remains 40% for 2018 taxes.) taxable income in 2018 is $30 million. required: 1. & 2. determine the type of accounting change and prepare the appropriate journal entry to record bronson's income tax expense in 2018 and adjustment, if any, is needed to revise retained earnings as a result of the change.

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

You decide that structural changes must be made at holden evans immediately to deal with the additional product lines. equipment and employees will have to be moved around to optimize production of all of the products in house. this shouldn't be too difficult because many of the vitamins and supplements are produced using similar processes. you have several options available to facilitate this process. which of the following methods do you think is the best choice? select an option from the choices below and click submit. because the changes may result in the loss of several key employees, you hire outside consultants who specialize in hr law. this way any employee terminations will not result in lawsuits. you select an outside consulting firm that your company has never worked with before, but it has a reputation for using new technology in product lines that are similar to yours. you select several trusted managers to facilitate the transition of operations from overseas. these individuals can gather information and also smooth any rough spots that may occur.

Answers: 3

Business, 22.06.2019 08:30

Most angel investors expect a return on investment of question options: 20% to 25% over 5 years. 15% to 20% over 5 years. 75% over 10 years. 100% over 5 years.

Answers: 1

Business, 22.06.2019 13:30

On january 2, well co. purchased 10% of rea, inc.’s outstanding common shares for $400,000, which equaled the carrying amount and the fair value of the interest purchased in rea’s net assets. well did not elect the fair value option. because well is the largest single shareholder in rea, and well’s officers are a majority on rea’s board of directors, well exercises significant influence over rea. rea reported net income of $500,000 for the year and paid dividends of $150,000. in its december 31 balance sheet, what amount should well report as investment in rea?

Answers: 3

Business, 22.06.2019 15:50

Evaluate a real situation between two economic actors; it could be any scenario: two competing businesses, two countries in negotiations, two kids trading baseball cards, you and another person involved in an exchange or anything else. use game theory to analyze the situation and the outcome (or potential outcome). be sure to explain the incentives, benefits and risks each face.

Answers: 1

You know the right answer?

Bronson industries reported a deferred tax liability of $8 million for the year ended december 31, 2...

Questions

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Computers and Technology, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

History, 29.04.2021 23:50

English, 29.04.2021 23:50

Arts, 29.04.2021 23:50

Mathematics, 29.04.2021 23:50

Biology, 29.04.2021 23:50